MARKET INSIGHT FOR THE WEEK ENDING October 20th

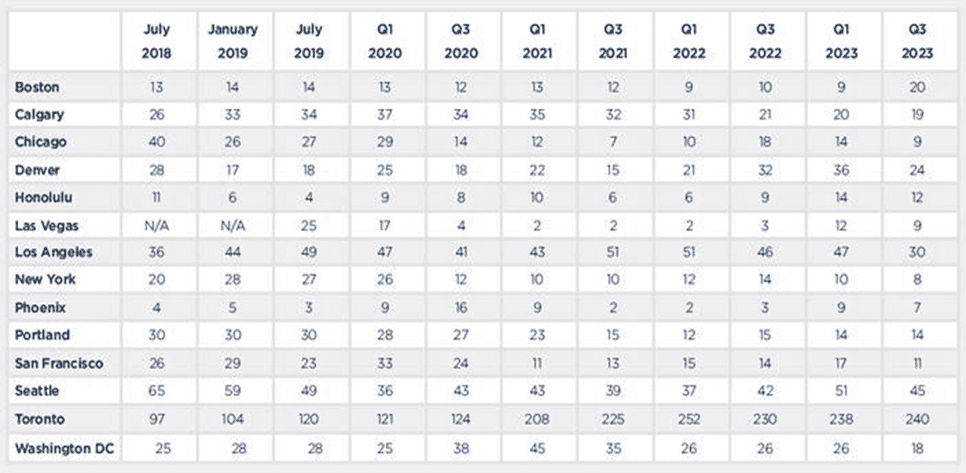

Does it Feel Like Toronto Has Way More Cranes Than It Used To? That’s Because They’ve Doubled. Toronto once again has, by far, the most cranes out of any city in North America, according to a new report.

Whether you’re for it or against it, every Torontonian can agree it feels like there’s now a new towering development going up on every block. As it turns out, that sense of increased high-rise development is entirely justified, as Toronto has now doubled its number of cranes compared to before the pandemic.

A new Crane Index report from Rider Levett Bucknall found that in the third quarter of 2023,Toronto had a staggering 240 cranes in the city. Not only is this the most out of all other North American cities measured — well outpacing second-place Seattle’s 45 cranes— but it’s about two times the 121 cranes seen in the first quarter of 2020.

The number of cranes in Toronto really took off in the first quarter of 2021, jumping to 208. It’s continued to grow consistently since then.

The residential sector continues to see the most consistent growth in crane count, up seven more cranes this quarter, however, the hospitality sector has dropped by four cranes in the past six months, the report says of Toronto. It’s worth noting that behind the relatively consistent crane counts, there’s been a very active ongoing construction scene, with over 50 new projects introducing cranes in the past six months. Of these new construction projects, 41 are residential projects, 7 are commercial projects, and the remaining three are institutional projects.

The construction of apartments has led the way in Toronto this year, with starts of this housing type jumping up 58% in the first half of 2023, according to CMHC.

The government of Ontario has been laser-focused on getting municipalities to increase their housing starts, implementing some often-contested tactics to do so. From holding forced refunds of application fees over the heads of municipalities for not approving development applications quickly enough to unveiling the Building Faster Fund — a $1.2B incentive program to reward municipalities for hitting or exceeding their housing targets — the province, has made clear that it sees cutting municipal red tape as a key in solving the housing crisis.

It doesn’t help, however, that at the same time a number of developers, both in Toronto and otherwise, have had to pause, postpone, or even cancel development plans as rising interest rates and fewer interested buyers have made projects less financially viable.

In an October report, CMHC noted that sales of new condos were down 52% between January and June of this year compared to the same time period in 2022.

“This has made it more difficult for developers to achieve the sales necessary to access construction financing,” CMHC said, also noting that “elevated construction costs and interest rates likely present challenges for future projects.”

Here are the top 5 trending stories of the week:

- Posthaste: Cooling housing market could spur Bank of Canada to cut rates sooner, says economist “Signs that housing market sentiment in Canada is heading south fast came in the latest real estate numbers out Friday. Canadian home sales fell 1.9 per cent in September from the month before while new listings jumped 6.3 per cent, according to data released by the Canadian Real Estate Association. ”

- Canadian rental market showing signs of slowing down “While most major markets in Canada reported rent increases in September, a potential sign of a slowdown is emerging, particularly in Toronto. The latest National Rent Report by Rentals.ca and Urbanation reveals that the Canadian rental market has continued its upward trajectory. Average asking rents across the country have seen a month-over-month increase of 1.5 per cent, reaching an average of $2,149. This marks an 11 per cent year-over-year growth, representing a nine-month high in the annual rate of rent inflation.”

- Real estate sector likely relieved after OSFI response on mortgage proposals: expert “The real estate industry is likely breathing a sigh of relief after Canada’s banking regulator signalled it might not move ahead with some proposed tightening of its mortgage lending rules, says one mortgage expert. The Office of the Superintendent of Financial Institutions floated the proposals in January as part of its wide-ranging review of the B-20 mortgage underwriting rules. It then invited feedback from stakeholders, including those from the banking, mortgage brokering and real estate sectors. “

- Canadian Housing Statistics Program: Real estate investors, 2021 “Today, the Canadian Housing Statistics Program is publishing data on investors and investment properties for the 2021 reference year. This release follows two articles on residential real estate investors published earlier this year and provides data for a new province, Prince Edward Island.”

- Sam Mizrahi’s ‘The One’ Placed Under Receivership “One of the tallest skyscrapers coming to Canada is facing significant financial trouble as Mizrahi Developments’ The One has been placed under receivership. According to court filings, a total of $1.235B is outstanding on loans provided by KEB Hana Bank for the development of The One. Further funds are owed to a number of other creditors, including over $201M to Aviva Insurance related to Tarion Warranty provision, $75M to Coco International, $213M to CERIECO Canada Corp. for a contractor’s loan, and $55M to NongHyup Bank..”

The Bosley Advantage

Read about the heritage and innovation that form the foundation for Bosley’s industry-leading approach to real estate.