MARKET INSIGHT FOR THE WEEK ENDING November 17th

Rent prices in Toronto are actually letting up while nearby cities are on the rise.

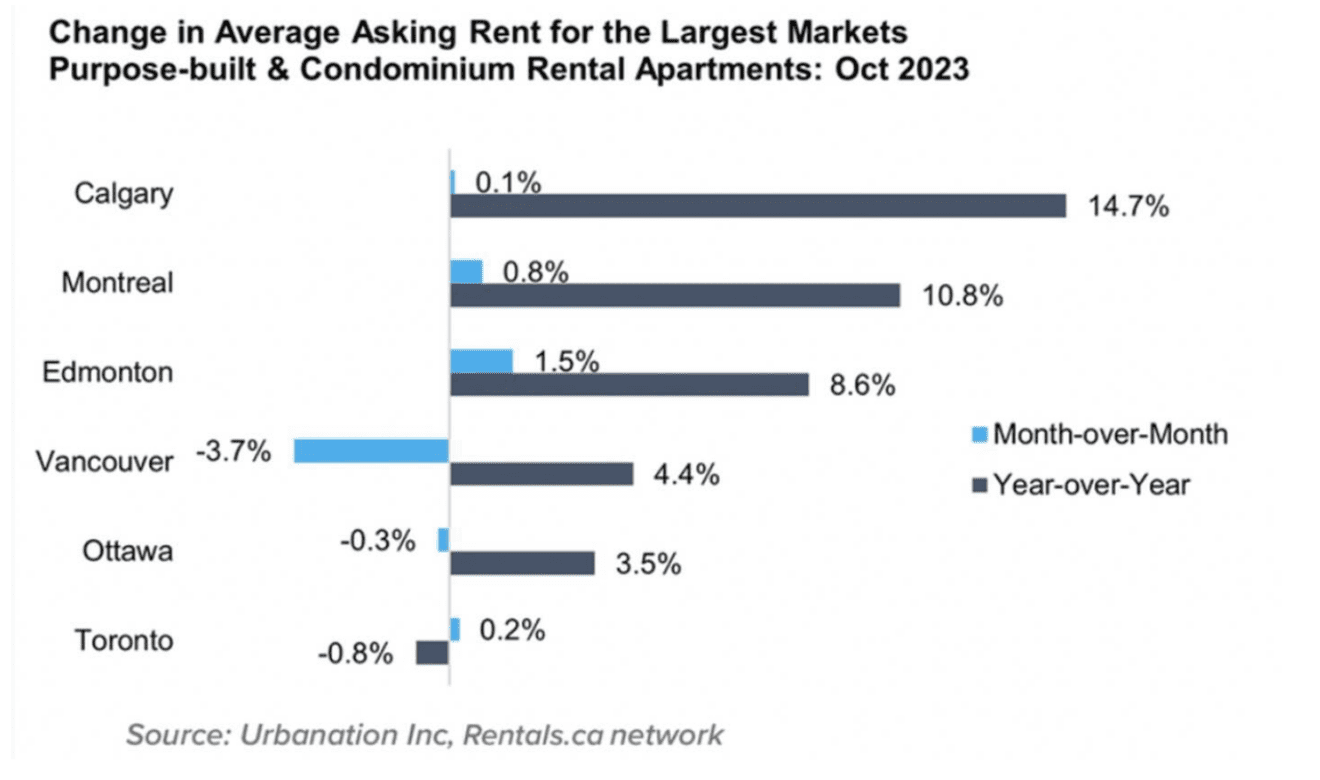

Rent prices in Toronto have declined marginally for some unit types while the cost of renting an apartment elsewhere in Canada is surging to new heights, according to a new report from Rentals.ca and Urbanation.

Rates have persistently risen by nearly $ 200 per month across the country for the last six months, and of course, residents of the nation’s largest and most bustling cities have it the worst as far as the housing crisis is concerned.

But, if there’s one thing Toronto residents are used to, it’s an exorbitant cost of living, and our rent rates have been spiking less dramatically on a month-over-month and year-over-year basis compared to other Canadian locals if that’s anything to be thankful for.

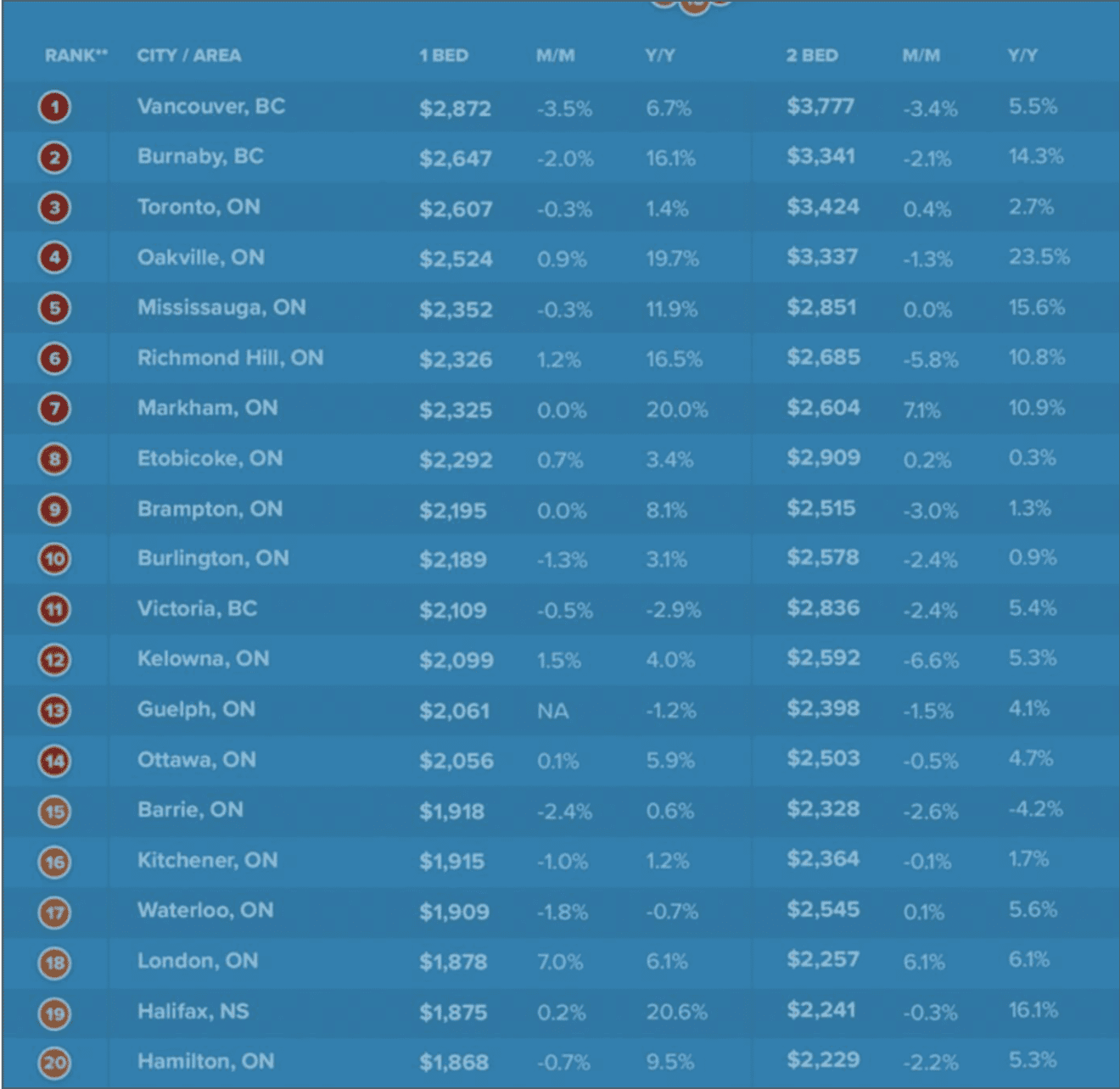

Last month, the price of a one-bedroom spot in the city declined — but by a mere 0.3 per cent — from September, hitting $2,607. This number also represents a slight 1.7 percent jump from October of 2022, while nearby cities like Markham, Oakville Richmond Hill saw much more substantive double-digit year-over-year hikes of 20 per cent, 19.7 per cent, and 16.5 per cent, respectively.

The story is the same for two-bedrooms, with Toronto’s price increasing just 0.4 per cent from the month prior and2.7 per cent from the same time last year — nothing compared to the 14.3 per cent year-over-year price surge for this size of an apartment in Burnaby, 23.5 per cent increase in Oakville and 15.6 per cent in Mississauga.

Looking to other provinces, Burnaby, B.C. has yet again beat out Toronto for the title of second-most expensive metropolitan area to rent in within Canada, with a monthly rate of $2,647 for a one-bedroom and $3,341 for a two-bedroom (16.1 per cent and 14.3 per cent higher compared to last year).

Toronto long held the spot second only to Vancouver but was surpassed by Burnaby for the first time in September.

But Toronto remains number two for roommate rentals, with an asking price of $1,312 for the typical bedroom in a shared flat — pretty stable from last month’s average of $1,308 — compared to $966 in Ottawa, $873 in Montreal, $911 in Calgary and just $737 in Edmonton.

Things are climbing at an especially fast past in Alberta, where apartments are now 16.4 per cent more expensive than they were at this time last year, and in Nova Scotia, where they are 13.6 per cent pricier.

Here are the top 5 trending stories of the week:

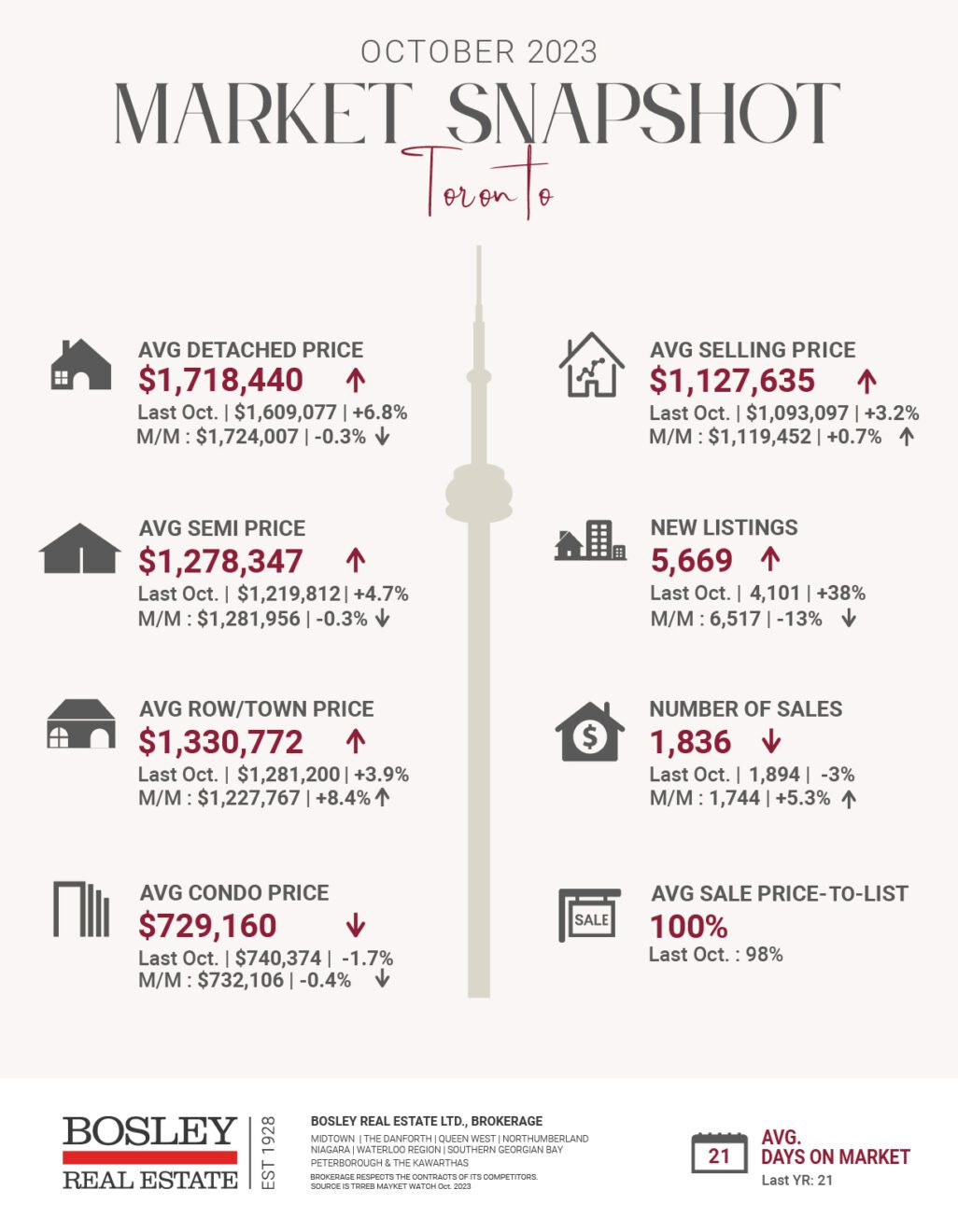

- Toronto: In buyers’ market territory for first time in decades “October marks another month of bad records for Toronto real estate. With sales down 5.8 percent since the same month last year, the region has posted one of the lowest numbers of October home sales to date. This suppressed sales figure is a clear sign that the Toronto real estate market is in a state of recession.”

- Canadian Mortgage Rates May Fall As Soft Inflation Lowers Yields “Canadians looking for some mortgage relief might get some in the coming months. At least for those looking for a fixed-rate term. This morning, Government of Canada (GoC) 5 year bond yields fell sharply in response to soft American inflation data. Falling yields are part of a broad trend currently driving down mortgage costs. Though how people respond to the return of cheap money may determine whether this trend continues, or inflation is reignited.”

- The impact of elderly households on the real estate market “The number of elderly households in Canada will increase significantly in the coming years and that will have an impact on Canada’s housing market. How long will elderly households hang on to their homes before selling? How many of these households are planning to downsize, buy condominiums, or move to the rental market?”

- Toronto Announces First City-Led Development Site “The City will develop 11 Brock Avenue, the former site of an LCBO in Parkdale just north of Queen Street West, into a 40-unit rent-geared-to-income supportive housing development. The project will be funded by a $21.6M commitment from the federal government’s Rapid Housing Initiative, as well as $3.4M in financial incentives from the City of Toronto which will come in the form of waivers of development charges and planning and building fees, as well as property tax exemptions.”

- Here’s what income bracket you need to be in to afford a home in Toronto right now “A new report from Ratehub.ca claims that homes in the city are becoming a bit more affordable now that most would-be buyers (read: investors) have been sidelined for so long. Even though there were 50 per cent more active listings in the GTA last month than at the same time last year, sales have been in a downturn, with the few who aren’t priced out of the market wanting nothing to do with in its turbulent, uncertain state.”

The Bosley Advantage

Read about the heritage and innovation that form the foundation for Bosley’s industry-leading approach to real estate.