MARKET INSIGHT FOR THE WEEK ENDING September 1st

At just the moment when more housing is desperately needed, three dozen condo buildings, adding up to more than 8,000 units, have been delayed in the GTHA (Greater Toronto and Hamilton Area) — many in more affordable communities — due to higher interest rates and a lack of confidence in the market.

According to market research firm Urbanation, more than 2,000 units are delayed in Hamilton, almost 3,000 in Toronto, and hundreds in cities in the Greater Toronto and Hamilton area such as Brampton, Burlington, Mississauga, and Oakville.

“In normal circumstances, you don’t really see that many projects being held back — they come to market, and that’s just not happening right now,” said Shaun Hildebrand, president of Urbanation. The firm counts delays as projects that were gearing up to launch (releasing marketing materials, etc.) since the second half of 2022, but did not end up being brought to market.

“I would say outside of a very brief period at the onset of the financial crisis in late 2008 or early 2009 there hasn’t been this much hesitation and market uncertainty since the 1990s, and I think it’s directly tied to interest rates.”

Just over 8,000 units in 31 projects across the city have been delayed, including 2,937 in Toronto, 694 in Oshawa, 350 in Brampton, 378 in Mississauga, and 365 in Clarington. Hamilton has seen 2,054 units delayed.

The high numbers in the GTHA make sense, Hildebrand said, as development has spread further from downtown Toronto. However, the delay of projects in the suburbs and cities on the outskirts of the region is “even more concerning” than those in Toronto as places like Hamilton are more affordable markets.

Higher interest rates impact both developers, who are also dealing with high construction costs, and buyers relying on mortgages to finance their home purchases. When developers can’t sell units, they push the projects off, Hildebrand said. As condos are one of the biggest sources of new homes in the GTA, and investors are “doing the heavy lifting” of providing new rentals, this will impact supply. “The province is off track, to say the least, to achieve its 1.5-million new homes goal,” he said.

“We think about there being a housing supply gap right now, it’s only going to get worse, given the current dynamics in terms of presale launch activity and sales.”

Some buyers started coming back when interest rates were paused in the spring, “but those two rate hikes (in June and July) just sort of pulled the rug out from under their feet,” he said. “It’s also the summer slowdown. We’re always a bit slow in the summer. I’m a bit fearful of what August and September are going to look like.”

Builders are “not going to keep bringing product if nobody’s buying it,” he said, adding that “talk of a looming recession” is also spooking buyers.

It’s hard to speculate on why GTHA communities like Hamilton have such high rates of delays. But it’s not a huge surprise that projects are being cancelled or delayed, given the economic environment.

People are waiting to see what happens on Sept. 6th, referring to the Bank of Canada’s next interest rate announcement.

In the long-term, Hildebrand still believes the outcome for condos and investors is good, given high immigration and low supply. “But I don’t think sales and new launches will bounce back quickly and return to previous highs reached in 2021 — it could take a while.”

Here are the top 5 trending stories of the week:

- Bank of Canada to hold rates steady on Sept. 6; home prices to fall in 2023 ” The Bank of Canada is expected to hold its key interest rate steady at 5.00% on Sept. 6 and stay at that level through at least the end of March 2024, according to a majority of economists in a Reuters poll, with a small but growing minority expecting one more rate rise. Inflation, which the Canadian central bank targets at 2%, rose more than expected to 3.3% in July, and further price rises continue to be the upside risk to expectations the BoC has already reached its terminal rate. “

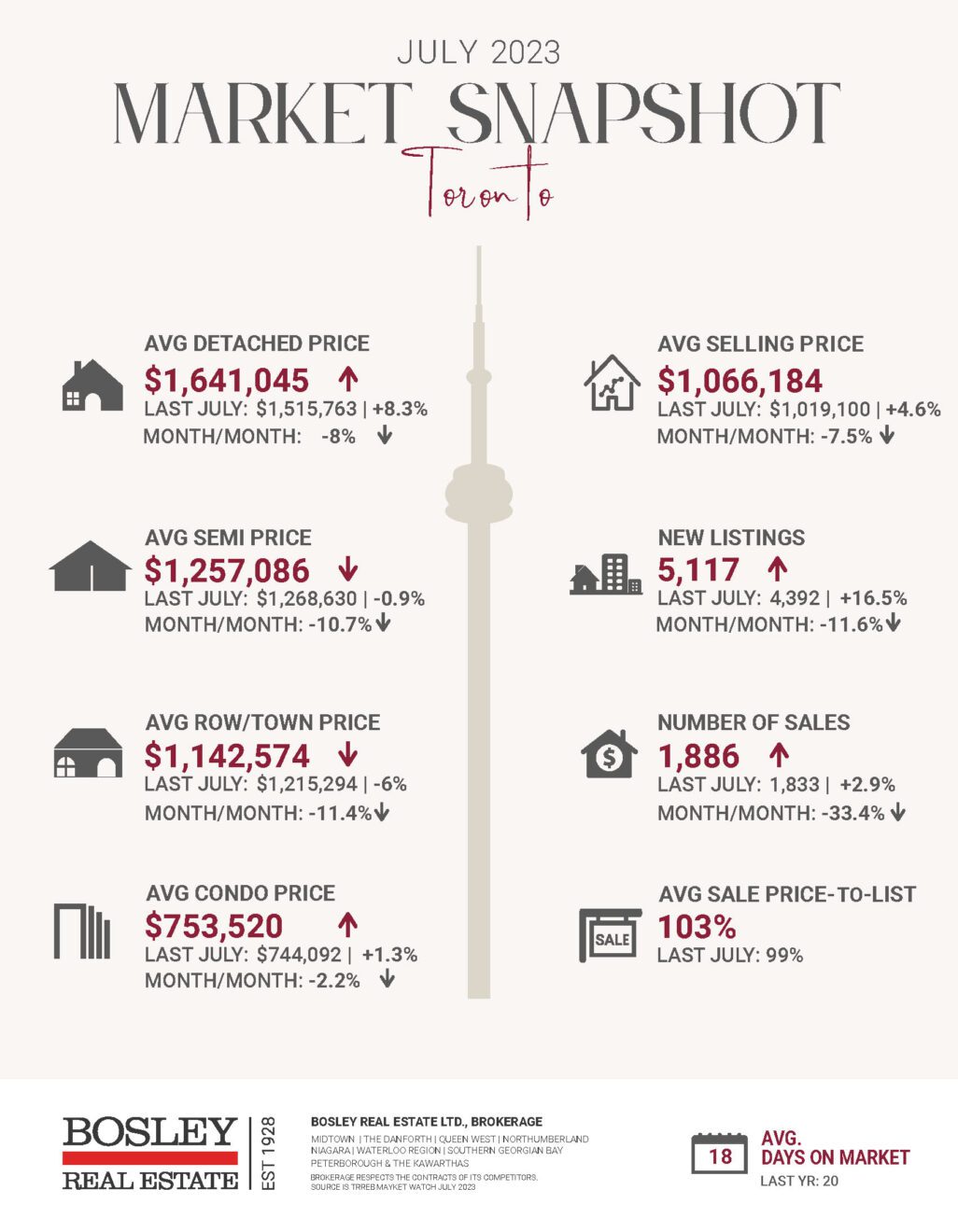

- Canadian Housing Market Data for July 2023 “Home prices in Western Canada are tumbling while Eastern Canada is seeing a general rise in prices for the month of July 2023. The outsized impact of BC and Ontario, with their significant housing markets, has caused Canada’s average home price to fall 6% compared to last month to $668,754, even as some provinces see a strong growth in home prices. The national average home price of $668,754 in July 2023 is a 6% year-over-year increase.”

- More Canadian homeowners extend mortgage amortization periods, Big Bank data reveal “The Chief of Staff for Ontario’s Housing Minister heavily steered the selection process for Greenbelt land removal in a manner that was “not transparent, objective, or fully informed,” and showed “bias” and “preferential treatment” to certain developers, found a report released by Auditor General Bonnie Lysyk on Wednesday morning.”

- Decades of policy failures spurred Canada’s housing crisis: Former deputy PM “Canada’s housing crunch is the result of decades of poor policy stemming from the federal government leaving the issue to the provinces in the 1980s, according to one former deputy prime minister. Former Deputy Prime Minister Sheila Copps said in an interview with BNN Bloomberg that when Canada Mortgage and Housing Corporation (CMHC) was involved in building housing, there was a significant amount of national investment in housing as well as housing policy and strategy.”

- Condo Amenities: 2023 Power Rankings “At a time when applications for new builds are seemingly endless, not all condo amenities are created equal. The common denominator is convenience: amenities should remove the requirement for residents to leave the building for everyday routines and rhythms. But, as life evolves, so do the types of amenities today’s (and tomorrow’s) condo dwellers really want — and need.”

The Bosley Advantage

Read about the heritage and innovation that form the foundation for Bosley’s industry-leading approach to real estate.