MARKET INSIGHT FOR THE WEEK ENDING September 8th

The City of Toronto will implement new Municipal Land Transfer Tax rates of up to 7.5% on high-value homes as it looks to potentially increase the Vacant Home Tax to 3%.

On Wednesday, the City of Toronto approved an updated long-term financial plan, laying out a number of new housing-related revenue streams for the City as it attempts to make up its funding shortfall.

As expected, a new graduated Municipal Land Transfer Tax (MLTT) rate was established for residential properties valued at $3M and above. A 3.5% tax will be applied to homes up to $4M, a 4.5% tax on homes up to $5M, a 5.5% tax on homes up to $10M, a 6.5% tax on homes up to $20M, and, finally, homes over $20M would be hit with a 7.5% tax.

The new MLTT rates, which are payable by a purchaser when they register their new property, will come into effect on January 1, 2024.

In the financial plan, Council also directed staff to develop a multi-year approach for property tax rates and report back to Council on the possibility of increasing the Vacant Home Tax rate from 1% to 3%. The latter, if implemented, would follow in the steps of Vancouver, which raised its Empty Homes Tax to 3% in 2021.

Council also requested reports on introducing a foreign buyer land transfer tax, an emissions performance charge for buildings, and an additional land transfer tax on buyers of residential property where the purchaser owns more than one property within Toronto, with some appropriate exemptions.

In an attempt to reduce expenditures and optimize assets, City staff will look into the feasibility of reducing or removing non-residential, non-ground floor area development charge exemptions, as well as complete a review of surplus or underutilized real estate assets and evaluate a possible graduated municipal property tax rate for high-value residential properties that are not a primary residence. Real estate sector breathes sigh of relief after Bank of Canada holds rate at 5%.

“The people of Toronto deserve a city where they can find affordable housing. Toronto is stepping up to meet our significant financial challenges and deliver the services people need,” Chow continued. “Despite the multiple actions approved by Council today we still need our partners – the Government of Canada and the Province of Ontario – to step up for the people of Toronto.”

Here are the top 5 trending stories of the week:

- Real estate sector breathes sigh of relief after Bank of Canada holds rate at 5% “With recent evidence that excess demand in the economy is easing, and given the lagged effects of monetary policy, governing council decided to hold the policy interest rate at five per cent and continue to normalize the bank’s balance sheet,” the central bank’s governing council said in a statement on its website.”

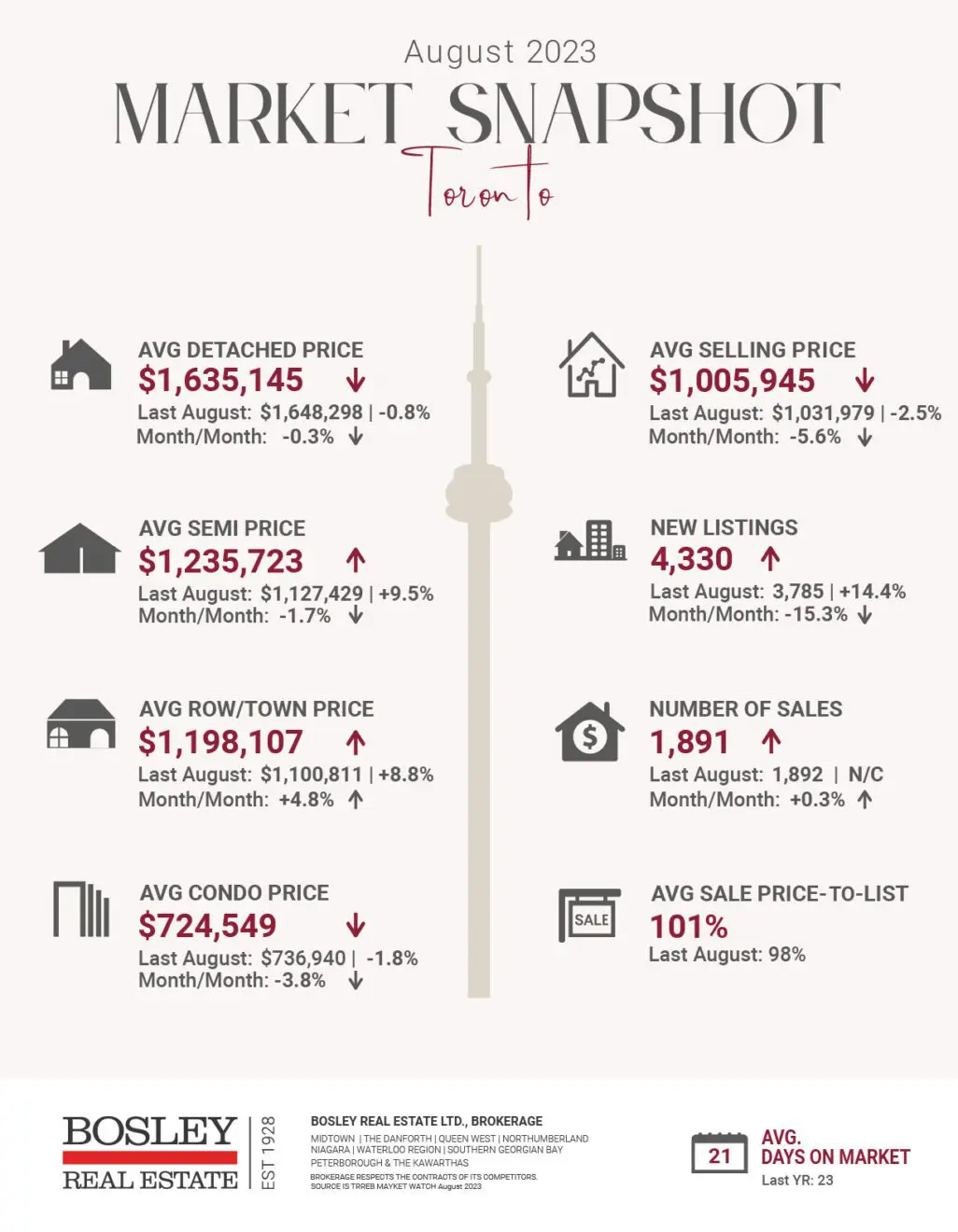

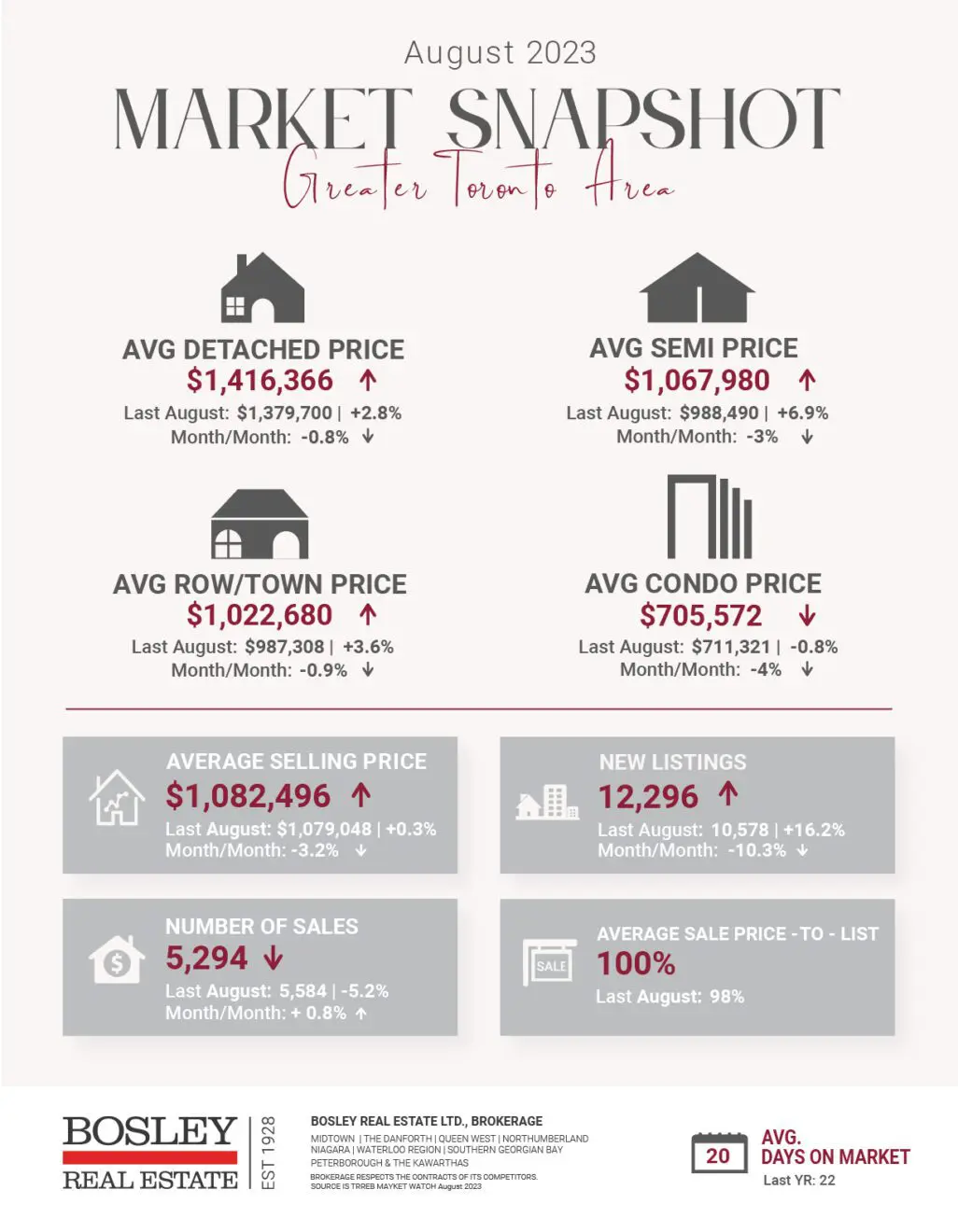

- Summer Stifle: GTA Home Sales, Listings Remain Flat In August “August saw a total of 5,294 sales across the GTA, just 44 more than were seen in July. Compared to the same time last year, however, August 2023 showed a 5.2% decline. Detached and semi-detached homes, specifically, were responsible for the overall decline, with sales down 12% and 14.4%, respectively, for the housing types. Townhomes and condos, which tend to be the more affordable housing types, saw sales increases of 0.6% and 7.6%, respectively.”

- Rate hold could push indebted homeowners into rental market: Experts “The Bank of Canada’s decision to hold interest rates at elevated levels could push over-leveraged homeowners into the rental market – driving prices higher in turn, experts say. The central bank decided to keep its overnight lending rate at five per cent on Wednesday, holding borrowing costs and mortgage rates at high levels after its steep hiking cycle began early last year.”

- Someone is renting out a closet for $1,000 a month in Toronto’s notorious ICE Condos “As if you needed another reminder about how unaffordable Toronto’s rental market has gotten recently, just take a look at this closet-turned “bedroom” that was recently listed for a staggering $1,000 per month in the city’s notorious ICE Condos.”

- Canadian Real Estate Might Get A Boost From BoC Pause, But It’s Unlikely: BMO “Canadian real estate experts are torn on the impact of the latest central bank move. Last time the Bank of Canada (BoC) paused interest rate hikes, home prices surged. BMO warns not to expect a replay after the latest BoC pause. The economy is in a very different place these days, and most importantly—unlike last time, there’s no mortgage rate relief on the horizon.”

The Bosley Advantage

Read about the heritage and innovation that form the foundation for Bosley’s industry-leading approach to real estate.