MARKET INSIGHT FOR THE WEEK ENDING June 30th , 2023

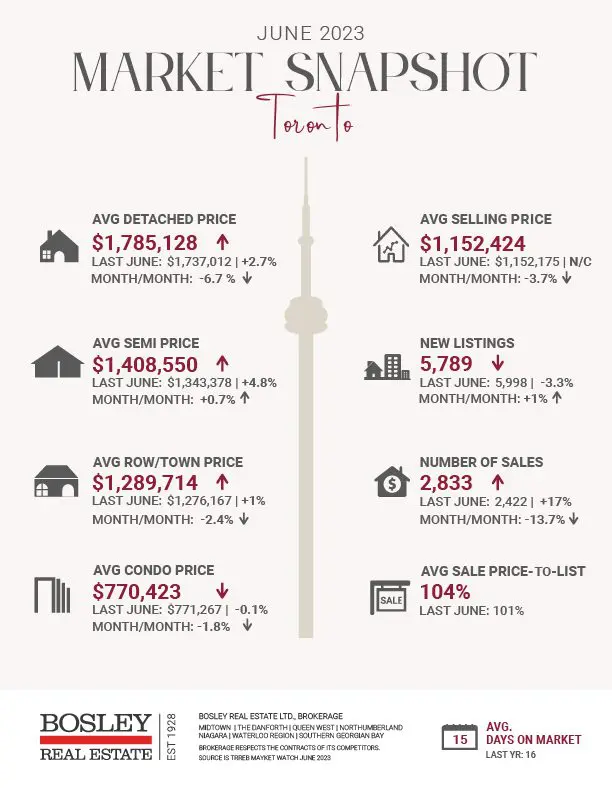

The average price of a home in the GTA is slightly higher than this time last year, but a bit flat month-over-month, according to the latest numbers from the Toronto Regional Real Estate Board (TRREB). Data shows that the average GTA price was about $1.182 million in June compared to roughly $1.146 million last June. Meanwhile, home sales are up 16.5 per cent from last June while listings dropped 3 per cent over the same period.

“We’ve definitely seen an improvement in the market. We were basically in a low this time last year as a result of increasing borrowing costs and their impact on the marketplace,” said Jason Mercer, the real estate board’s chief market analyst.

“We have seen a pretty strong uptake year-over-year in terms of sales.”

This suggests, he said, that buyers who “moved to the sidelines” when interest rate hikes started in 2022, may have accepted the higher borrowing costs, saved more for a down payment or are looking at a different type of home.

Released Thursday, the data shows that the average GTA home price was about $1.182 million in June compared to roughly $1.146 million last June and $1.196 million this past May.

There were 7,481 home sales reported in the region over the month of June. The market is now “tighter” Mercer said, with sales up year-over-year and listings down, which means there’s more competition for people trying to purchase a home.

“You can’t buy what’s not available for sale,” he said. “And I think that is starting to have an impact on sales, people just can’t find what they’re looking for.” The average price of a detached home in the city of Toronto was almost $1.8 million in June, up 2.6 per cent from last year, while the average price of a condo at $770,423 was down 0.2 per cent.

In the 905, the average price of a detached home was up 6.6 per cent year-over year to roughly $1.45 million, but the average condo price was down 2.7 per cent to $674,305.

There’s been more uncertainty in the market over the last month, with concerns around inflation and the Bank of Canada’s decision to raise interest rates again in July. After historic lows during the pandemic, the bank hiked rates eight times before leaving them unchanged in spring 2023.

The next rate announcement is on July 12. A majority of economists believe the Bank of Canada will raise interest rates by a quarter-point for a second straight time to 5.00% and then hold well into 2024.

“I think everyone’s looking very closely at both what the bank does in terms of its policy rate next week, but also what their expectations are for later in the year,” Mercer said.

Here are the top 5 trending stories of the week:

- What to expect from the next Bank of Canada interest rate announcement “The Bank of Canada will issue an interest rate update on July 12. This will mark the fifth interest rate announcement of 2023. Three more are scheduled to follow this year.In 2022, the bank hiked its interest rate seven times. Then, in January 2023, another increase followed, bringing the key rate to 4.5%. The central bank held its key rate at 4.5%, precisely as experts predicted, until June 7, when it was raised to 4.75%.These hikes are primarily aimed at relieving inflation. Canada’s inflation rate fell to 3.4% in May, but Statistics Canada reports that consumer spending has remained high. “

- Ontario Reaches “Crisis Point” As Housing Affordability Impacts Communities Of All Sizes “Following the correction that began in the spring of 2022, Canada’s housing markets have rebounded sharply over the last several months. The national average home price hit $729K in May, a monthly increase of $13K, and more than a $116K jump from January. Meanwhile, home sales have risen consistently month over month since February.”

- Income gap between Canadian households increases at record speed: Statistics Canada “The share of disposable income between Canada’s highest and lowest households widened in the first quarter of 2023, according to data released by Statistics Canada. The gap between the top 40 per cent and bottom 40 per cent of household incomes reached 44.7 per cent, marking a 0.2 per cent rise from the same time last year, the findings released on Tuesday showed. The figure was still lower than pre-pandemic levels, which averaged 45.1 per cent from 2010 to 2019, the data revealed.

- Toronto’s downtown core is in major trouble as office vacancy rate soars “Despite lockdowns fading into the past, more and more Toronto companies continue to opt for hybrid work models, meaning lots of formerly-occupied office spaces remain largely vacant throughout the work week. “

- Immigration and employment driving housing market recovery: report “The Canadian housing market has made a remarkable comeback, defying expectations of a housing correction, according to the Desjardins Canadian Residential Real Estate Outlook.Randall Bartlett, senior director of Canadian Economics, and Helene Begin, principal economist, attribute the resurgence to various factors.”

The Bosley Advantage

Read about the heritage and innovation that form the foundation for Bosley’s industry-leading approach to real estate.