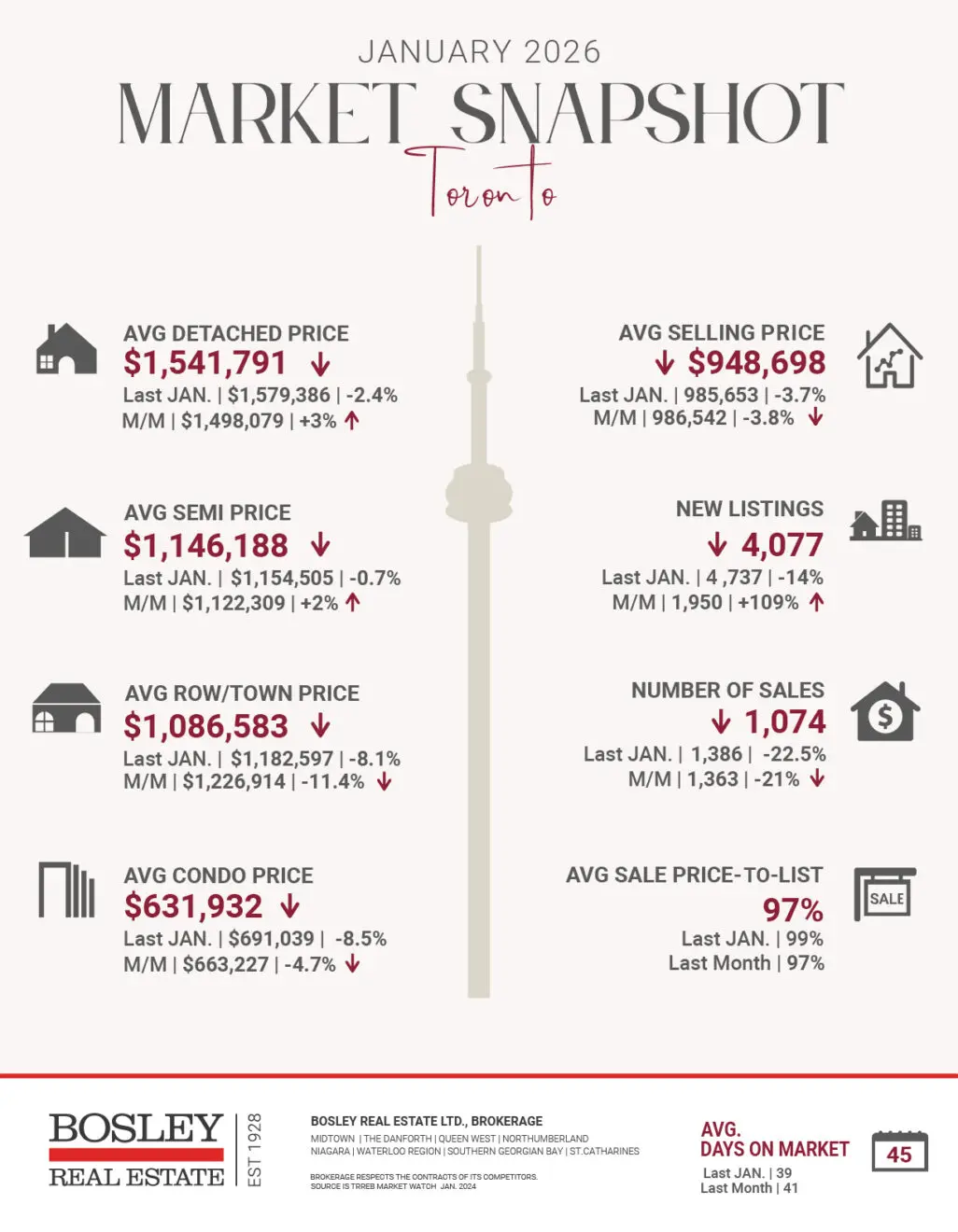

Home prices in the Toronto area have dipped below the $1 million mark for the first time in five years, offering a notable shift in the market.

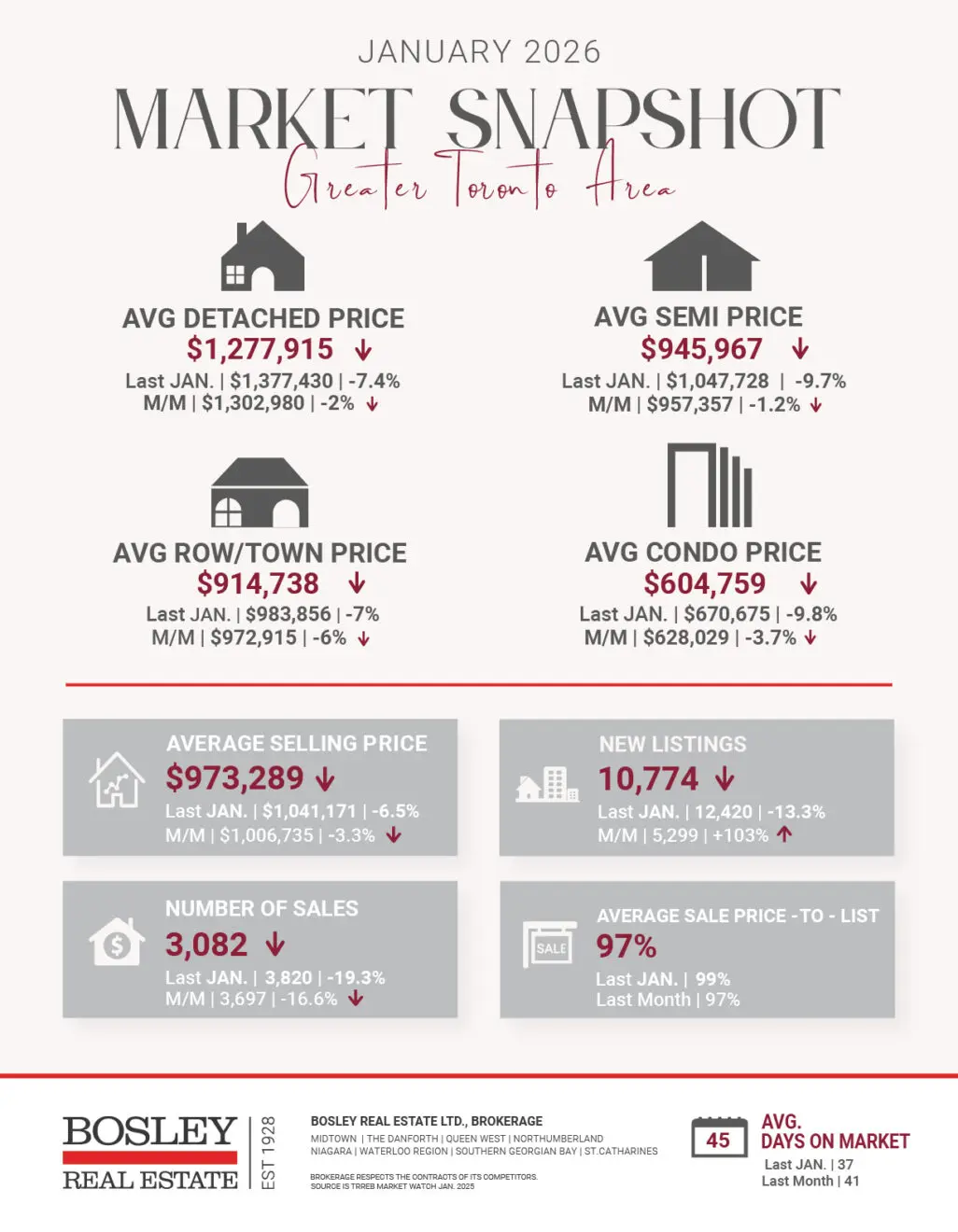

The average selling price of a GTA home in January was $973,000, down 6.5 per cent from the same time last year, according to the Toronto Regional Real Estate Board’s (TRREB) Wednesday report.

The last time the average price was at a similar level was January 2021, when it sat at $966,700.

“The housing market reflects the tension many households are feeling as we look ahead to 2026. While affordability has improved, uncertainty continues to influence long-term decisions like homeownership,” TRREB president Daniel Steinfeld said in the report. Sales slowed in January, with just over 3,000 transactions, down 19.3 per cent year over year.

“Greater economic clarity in the months ahead could restore confidence and help unlock demand that has been building for several years.”

The average sales price for all property types has declined by 27 per cent since the February 2022 peak. Some economists define a 30-per-cent price drop as a housing crash, though current levels remain just below that threshold.

TRREB’s Market Outlook, also released on Wednesday, suggests prices and sales are expected to remain relatively stable in 2026. However, improved affordability could help bring more first-time homebuyers into the market.

Experts say this group is generally older than previous generations, have accumulated savings and may be better positioned to buy as monthly rent is no longer significantly lower than mortgage carrying costs. In contrast, “move up” buyers without immediate pressure are more likely to remain patient.

TRREB expects 2026 to closely resemble the sales levels of 2025, according to the market outlook, which marked a 25-year low. Ontario’s largest real estate association forecasts between 60,000 and 70,000 sales in 2026. Last year we saw 62,433 sales, the lowest annual total since 2000.

Market activity in the first half of the year is expected to mirror 2025 levels, as many households continue to be cautious about committing to long-term mortgage payments.

Canada and U.S. relations remain strained amid ongoing trade threats, and broader geopolitical and economic factors are still contributing to uncertainty for some buyers.

While sales could see modest gains, home prices are expected to stay relatively flat, TRREB said. The outlook report forecasts the average price to range between $1 million and $1.03 million this year.

An abundance of supply continues to provide buyers with more choice and negotiating power, placing some downward pressure on pricing, the report noted.

“With the cost of borrowing flattening out, affordability gains in 2026 will largely be seen on the pricing front, as buyers continue to benefit from negotiating power,” TRREB chief information officer Jason Mercer said.

“A boost in consumer confidence could see buyers step off the sidelines later this year, which could help support home prices as market conditions gradually tighten.”

First-time homebuyers are expected to be a key driver of sales in 2026 as affordability improves. This group is not typically young, with the average age closer to 40.

Many of these buyers have had time to save during the first 10 to 15 years of their careers and are now positioned to enter the market, seeing opportunities in property types that may have previously been out of reach.

This cohort grew up hearing that homeownership in Toronto was unattainable, but today the monthly cost of rent and owning is narrowing.

Meanwhile, discretionary or “move up” buyers looking to purchase a larger home are more likely to wait, as their move is not essential.

With some lingering economic uncertainty, they may choose to pause for several months to a year before making a decision.

HERE ARE THE TOP FIVE TRENDING STORIES OF THE WEEK:

RBC and REALTOR.ca team up to simplify the path to homeownership for Canadians

RBC and REALTOR.ca have launched a strategic partnership to integrate mortgage financing tools and expert financial advice directly into Canada’s largest home search platform. This collaboration aims to enhance financial literacy for prospective buyers through AI-enabled advice and co-branded educational resources, specifically timed for the 2026 spring buying season.

Power of sale listings spike across Ontario, piling pressure on housing market

Ontario is seeing a significant surge in “Power of Sale” listings as homeowners and private lenders struggle with the impact of sustained high interest rates. This spike in forced sales is increasing inventory in a market that is already seeing record-low transaction volumes, putting further downward pressure on home prices across the province.

End Of An (Easing) Era? Some Economists Warn Of BoC Hikes

While the Bank of Canada recently held its policy rate at 2.25%, a group of economists is warning that the era of interest rate cuts may be over. Factors such as sticky food inflation, potential trade tariffs, and new government rebates are creating upside risks to inflation. While most expect rates to remain on hold through 2026, some analysts suggest that the next move for the central bank could actually be a hike to “normalize” policy.

Ontario’s real estate regulator freezes bank accounts of four Mississauga brokerages

The Real Estate Council of Ontario (RECO) has issued an emergency freeze order on the bank accounts of four “Save Max” brokerages in Mississauga after discovering that $2.7 million in trust funds was disbursed unlawfully. The investigation found that consumer deposits were being used to pay for loan payments, property management fees, and credit card balances. RECO has notified the Peel Regional Police and moved to revoke the registrations of the brokerages and key individuals involved.

Canada’s commercial real estate scene is banking on a $56-billion injection this year

A new report from CBRE Canada predicts that commercial real estate investment could reach $56 billion in 2026, driven by nationwide return-to-office mandates. If realized, this would be the third-highest investment total in Canadian history. While Toronto’s office vacancy rate is expected to drop to 13.4%, the industrial sector faces a more challenging outlook due to potential U.S. trade tariffs and ongoing CUSMA negotiations.

The Bosley Advantage

Read about the heritage and innovation that form the foundation for Bosley’s industry-leading approach to real estate.