MARKET INSIGHT FOR THE WEEK ENDING September 22nd

On a monthly basis, average home prices fell in six Canadian cities and increased in four urban markets in August, according to a new market survey by Ratehub.ca.

“Mortgage rates continued to increase slightly from July to August 2023 with the stress test remaining above 8%,” said James Laird, co-CEO of Ratehub.ca. “As a result, home affordability has worsened in the majority of the cities we looked at.”

This was particularly apparent in Vancouver, where buyers will need $1,480 in additional income to buy a home despite the average purchase price dropping by $2,300 last month.

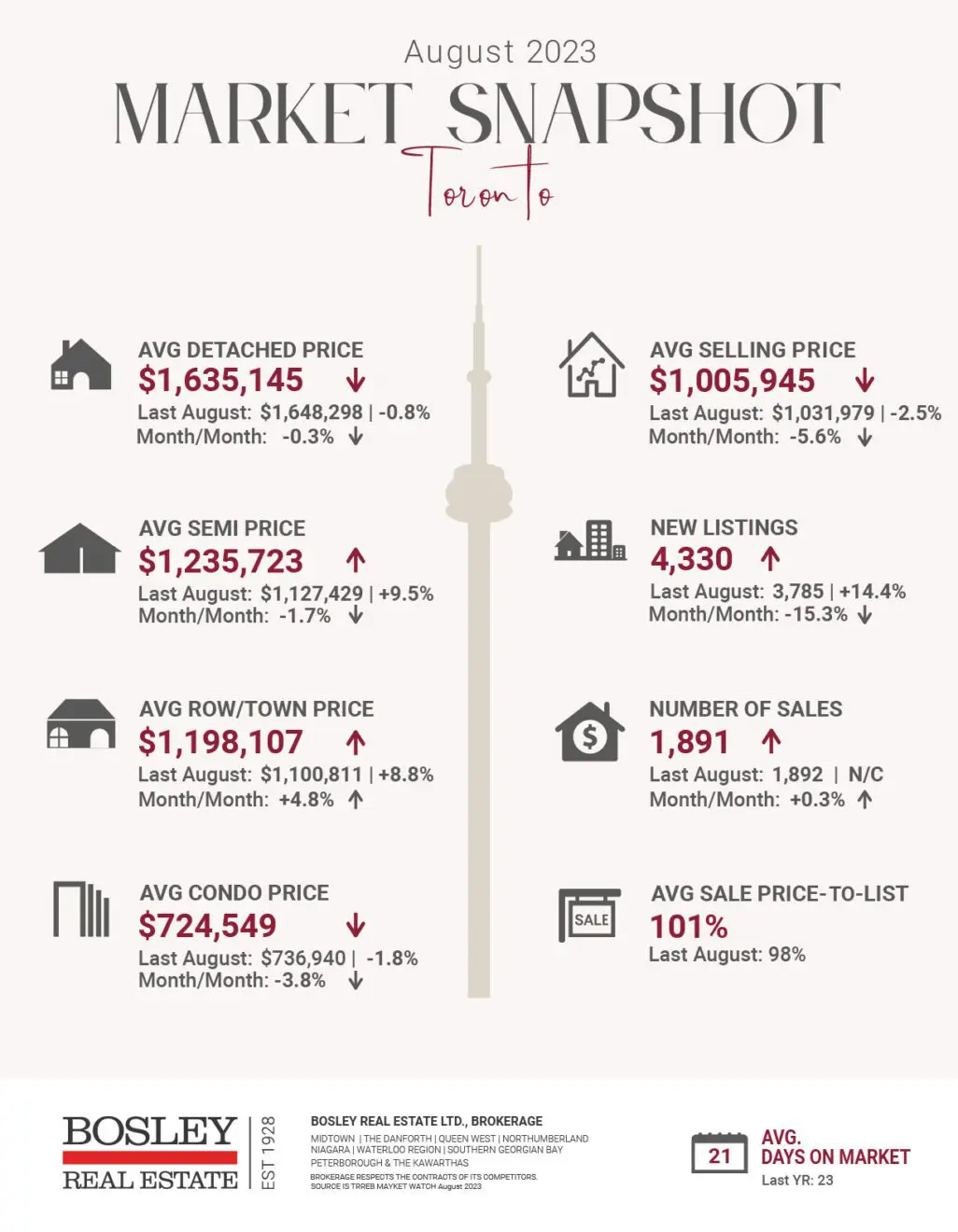

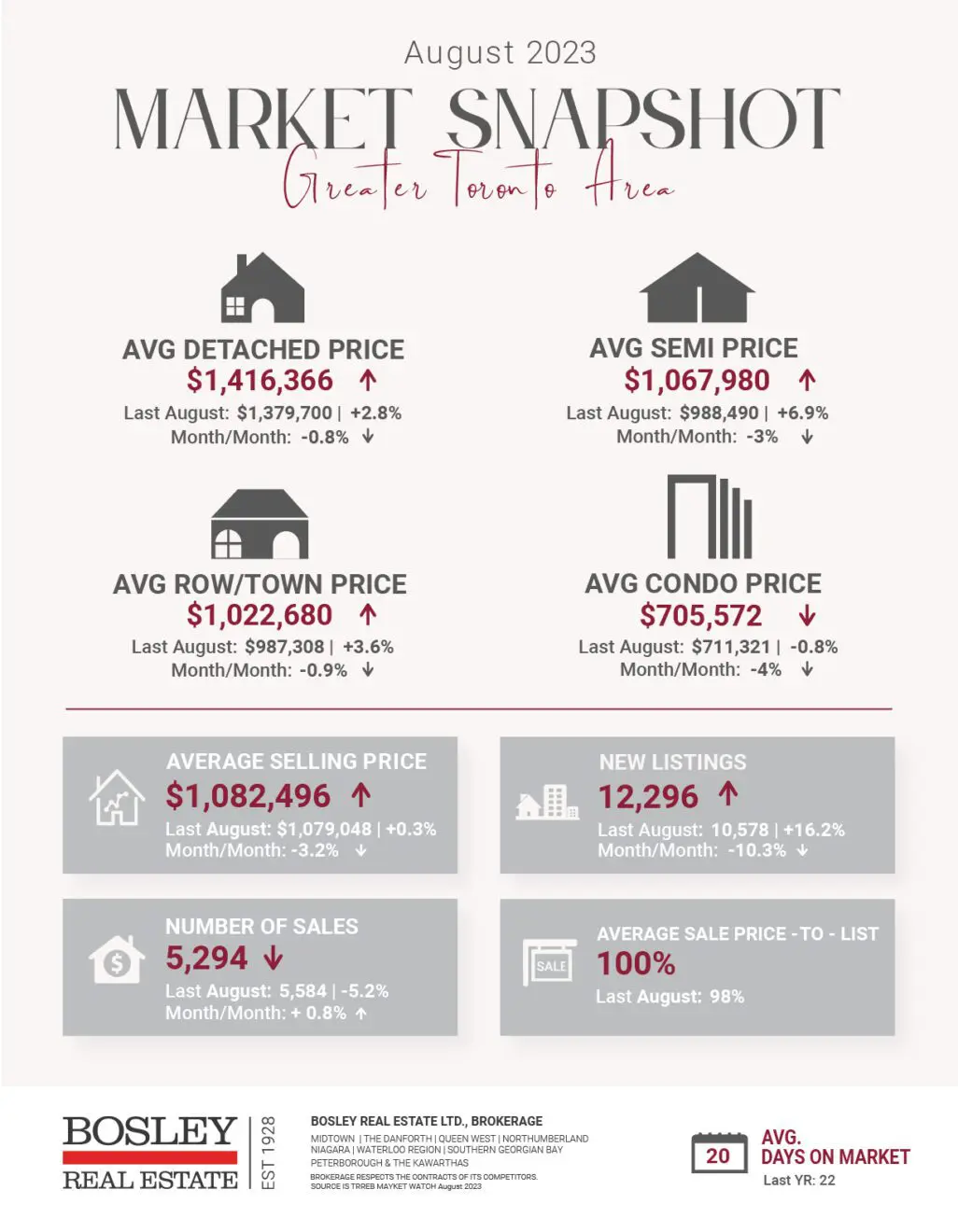

At the other end of the spectrum, Toronto registered the largest monthly home price decrease at $19,800.This price decline was significant enough to make an impact on home affordability, with $1,950 less income needed to purchase an average home in the city.

Here are the top 5 trending stories of the week:

- Survey suggests 20% of Canadian homeowners considering selling in the next 3 years “There have been rumblings among realtors that the rising cost of owning a home and increasing mortgage rates could lead to panic selling among a number of homeowners, and a recent survey is shedding light on Canadians’ intentions to sell their properties. More than 20 per cent of homeowners plan to sell their primary residences within the next three years, according to a survey conducted by Nerdwallet and The Harris Poll, which involved 1,099 Canadian adults, including 749 homeowners.”

- The removal of GST will have an ‘immediate’ impact on rental builds “Just days after Canada Mortgage and Housing Corporation warned of a dire housing shortage, the Canadian federal government announced it would remove the Goods and Services Tax (GST) on the construction of new apartment buildings for renters. “

- Everyone is talking smack about the shoddy quality of Toronto’s new condos “Condo construction feels never-ending in Toronto, where developers continue to jam shiny skyscrapers into new parts of the downtown core, whether it means the destruction of a beloved institution, the gutting of a historic structure or just the inevitable death of a parking lot.”

- How Population Growth Has Impacted Housing Inventory In Canada “According to the latest date from the Canadian Real Estate Association (CREA), there were just 3.5 months of inventory available in August, well below the long-term average for the measure of five months. As inventory has fallen — in January there were 4.3 months, in December 2022 4.2 months — Canada’s population has skyrocketed. In June, as inventory slipped to 3.1 months, Canada’s population hit 40 million people, 1.2 million of whom immigrated in the last year.”

- Ontario post-secondary graduates delaying homeownership due to student debt, OREA report finds “A large number of young adults are delaying homeownership in the province, citing student debt as the “primary reason” for postponing this milestone, a new poll by the Ontario Real Estate Association (OREA) suggests.”

The Bosley Advantage

Read about the heritage and innovation that form the foundation for Bosley’s industry-leading approach to real estate.