MARKET INSIGHT FOR THE WEEK ENDING August 11th, 2023

Real estate investors are exiting the market as new listings in Toronto trend up and interest rates remain high, experts say.

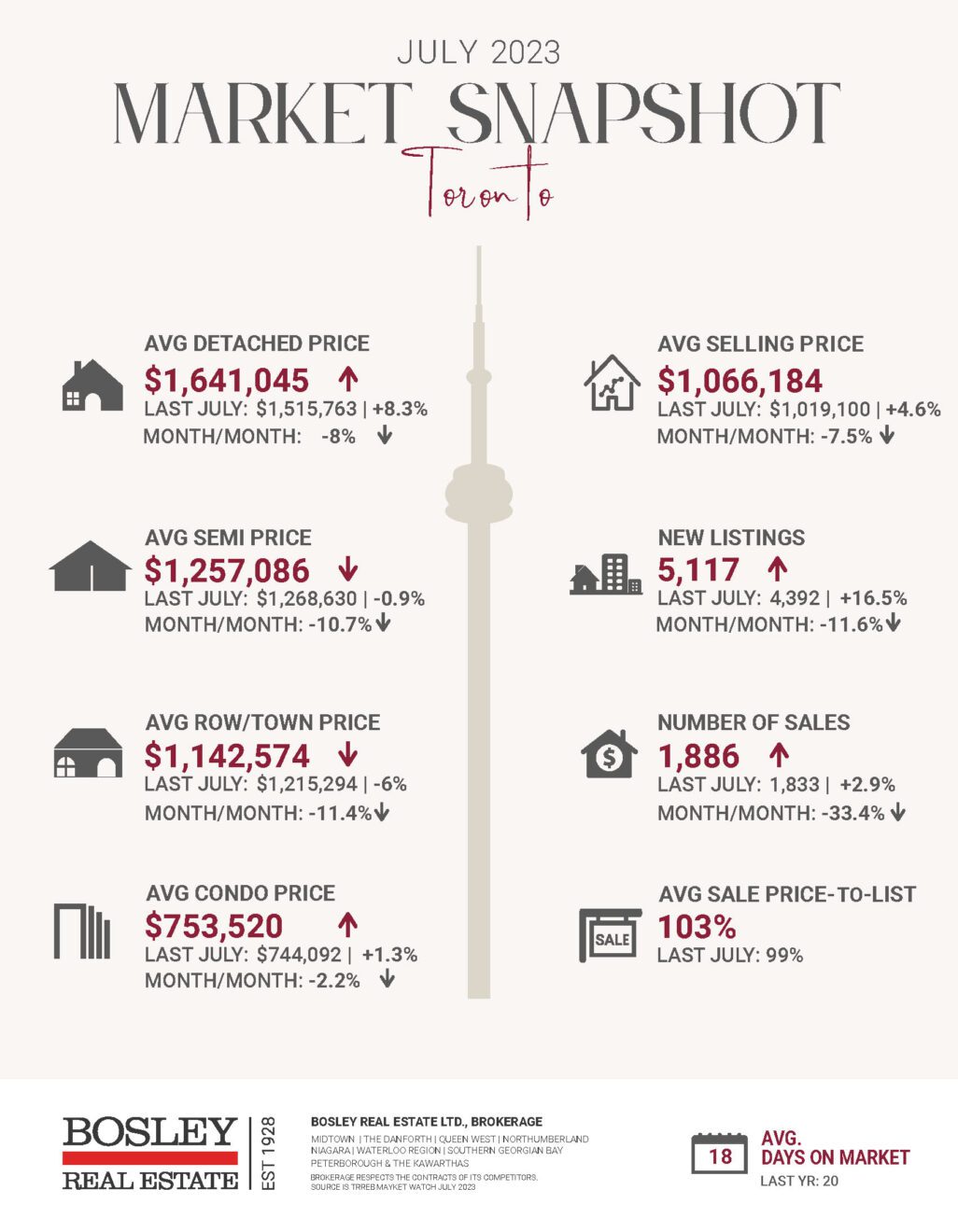

In July, new listings increased by 11.5 per cent annually and condominiums had the highest percentage rise in sales volume compared to single-family homes, increasing by more than 11 per cent annually.

Investors who bought from 2020 to 2022 when interest rates were at extreme lows have seen their mortgage rates triple. They’re putting their rental properties up for sale as their cash flow has diminished. A whopping 36 per cent of the condos in Toronto are owned by investors.

The properties trickling into the market now are typically from investors with multiple properties who are over-leveraged and are having to constantly refinance. Their cash flow is essentially gone because of elevated interest rates, adding that rent can’t be raised to adjust to higher mortgage payments without getting new tenants.

There is this sense that with more new listings, it will free up supply for homebuyers, and while some of it will, that means fewer options for renters. Rents for GTA condos continued to soar, hitting an average of about $2,800a month in the second quarter of 2023, according to market research firm Urbanation.

The majority of investors who purchased pre-construction condos to use as rentals weren’t making money in 2022, the first time such a scenario has occurred. Only 48% of newly completed condos were cash flow positive last year, compared with 56% in 2021 and 60% in 2020, meaning that the rent investors collected from tenants was lower than their mortgage costs, condo fees, and property taxes.

Currently, variable rates hover in the mid-six-per-cent to low seven-per-cent range at all the major banks, while fixed rates are in the mid-five-per-cent to low- six-per-cent range.

“This marks a meaningful shift that may potentially signal that a change in investor behavior is on the horizon,” the report notes.

Over the next 12 months we’ll see more investors sell their rental properties, but we won’t see a massive wave of new listings and it still won’t be anywhere close to meet demand.

Here are the top 5 trending stories of the week:

- Tens of thousands of Canadians taking advantage of the new First Home Savings Account: RBC “The Royal Bank of Canada says it has seen a “phenomenal early uptake” in the First Home Savings Account (FHSA), a new program where prospective homebuyers can start saving and investing for a down payment tax-free. In a news release Thursday, RBC said Canadians have opened “tens of thousands” of accounts since the rules for the program came into effect on April 1.”

- Toronto’s market shows signs of balance in July “In its Market Watch for July, the Toronto Regional Real Estate Board (TRREB) states that the real estate market was more balanced, and I’d generally agree with that. The market is behaving in a fashion that doesn’t favour buyers or sellers. This is especially visible when looking at the average sale price compared with the average list price, evidence that buyers and sellers are adapting to meet their counterparty’s expectations.”

- “Biased Process, Preferential Treatment”: Report Finds Greenbelt Lands Removal Influenced By Developers “The Chief of Staff for Ontario’s Housing Minister heavily steered the selection process for Greenbelt land removal in a manner that was “not transparent, objective, or fully informed,” and showed “bias” and “preferential treatment” to certain developers, found a report released by Auditor General Bonnie Lysyk on Wednesday morning.”

- Canadian housing permits decline to $6.9 billion in June “The number of residential building permits issued in June ticked up slightly from May, but the overall value fell 1.8 per cent to $6.9 billion, a dip that comes after several months of steady growth in the construction sector.”

- Edmonton and Calgary become top-searched cities for real estate “Canada’s ability to attract talent is making it a victim of its own success. Statistics Canada (Stat Can) data revealed minimal job losses for July 2023. However, the unemployment rate climbed as population growth doubled the rate of jobs. This helped drive the unemployment to the highest level since the start of 2020.”

The Bosley Advantage

Read about the heritage and innovation that form the foundation for Bosley’s industry-leading approach to real estate.