MARKET INSIGHT FOR THE WEEK ENDING September 29th

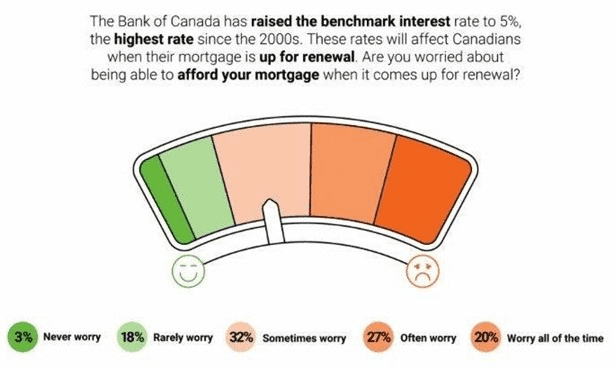

Soaring interest rates are inducing anxiety in nearly half of Canadian homeowners for whom mortgage renewal looms. Interest rates have risen from 0.25% to 5% in 18 months.

Twenty percent of homeowners “worry all the time” about their ability to afford their mortgage when it comes up for renewal — a figure that has risen 9% in just a year — and another 27% “worry often.” Just 3% were unbothered by the proposed predicament.

Amidst stubbornly high inflation, more than 9% of homeowners are already struggling financially, and nearly 30% are in a “tight” financial situation but are managing.

The findings polled 800 Canadians on their home-buying experience and sentiment, as well as their feelings on the economy and real estate market.

The majority of homeowners surveyed are up for renewal in the next two to three years. If they opted for a five-year fixed-rate mortgage, which has historically been the most popular in Canada, they did so when the Bank of Canada’s (BoC) overnight rate was between 0.25% and 1.75%. It’s now at 5%.

For those on a variable-rate mortgage, though — particularly those with fluctuating payments — the anxiety has been realized 10 times over since the Bank of Canada began hiking rates in March 2022. One respondent who

purchased a home in 2021 said their monthly mortgage payments have already risen by roughly $2,500.

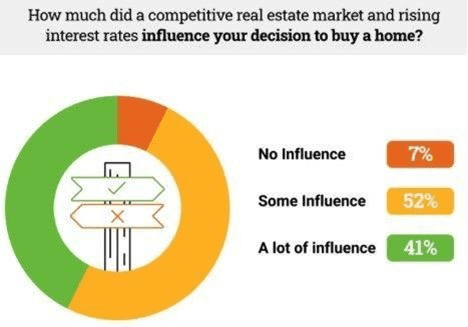

In addition to causing anxiety for the future, interest rates also played a role in a homebuyer’s initial decision to purchase property. Forty-one percent of those surveyed said rising rates and a competitive real estate market had “a lot” of influence on their decision to buy a home, and another 52% said the factors had at least “some” effect.

While many economists believe the BoC will begin cutting interest rates in early to mid-2024, there is little consensus on whether they will hike again in the interim, with the bank itself stating it is “prepared ” to do so if underlying inflationary pressures persist.

Should such a situation occur, 9% of survey respondents said they would be unhappy in their home. However, 45% indicated they would still be happy even if the BoC delivers another hike before the end of the year — a “hard-pressed but happy outlook” on homeownership.

Here are the top 5 trending stories of the week:

- Real estate in Vancouver and Toronto no longer in bubble risk territory “A new global real estate report suggests that real estate in Canadian metros Vancouver and Toronto is finally out of the bubble risk. Published Wednesday, the annual UBS Global Real Estate Bubble Index discusses deflating real estate bubbles worldwide.”

- Posthaste: Canadians could be gearing up to enter the housing market again“Some Canadians who’ve been sitting on the sidelines of the housing market in the face of high prices and interest rates might be getting ready to jump back in, new research suggests. Home-buying intentions appear to be rising, according to the latest consumer pulse report released this morning from Dye & Durham Corp.”

- Here’s how long you need to save up to buy a condo in Toronto “Preparing to purchase your first condo in Toronto can be an incredibly stressful experience (to say the very least), given all the uncertainties that come with the city’s real estate market through increased competition and rising costs. According to the Toronto Regional Real Estate Board (TRREB), the average one-bedroom condo apartment rent in Q2 2023 was a staggering $2,532, representing an 11.6 per cent increase from Q2 2022. “

- Feds Unlocking $20B In Low-Cost Financing For Construction Of Rental Apartments ” The federal government is unlocking $20B in low-cost financing for the construction of rental apartments. The annual limit for the Canada Mortgage Bonds program is being increased from $40B to $60B, Chrystia Freeland, Deputy Prime Minister and the Minister of Finance, announced on Tuesday. The program generates funds for residential mortgage financing. The increase will unlock low-cost financing for multi-unit rental construction, and help to build up to 30,000 additional apartments per year across the country. It has no fiscal impact on the federal government, Freeland noted. “

- Canada home prices rose for sixth consecutive month in August: index “Housing prices across Canada rose in August, marking their sixth consecutive monthly rise, according to new data from the Teranet-National Bank House Price Index. The index rose by 0.6 per cent from July to August prior to seasonal adjustments, and 1.6 per cent after seasonal adjustments were made. All 11 metropolitan areas included in the index recorded home price increases in August, the first time that has happened since March 2021, according to a press release on the findings. The strongest growth was reported in Calgary at 3.5 per cent. Vancouver and Hamilton reported the second-strongest growth, at 2.8 and 2.4 per cent respectively.”

The Bosley Advantage

Read about the heritage and innovation that form the foundation for Bosley’s industry-leading approach to real estate.