Competition Bureau Issues Warning on Rental Price Collusion

Canada’s federal competition regulator has issued a cautionary note to landlords and property managers regarding potential rent price coordination, triggering both criticism and curiosity about how such conduct might develop.

“The Competition Bureau is aware that certain landlords and property managers could be engaging with their competitors, including through social media discussion groups. Although some interactions among competitors may be lawful, others might breach the law,” stated a bulletin from the Competition Bureau of Canada on June 25.

While the Bureau did not disclose details of active investigations, it did confirm that reports and tips it has received suggest that illegal coordination is occurring on encrypted platforms like WhatsApp, Signal, and Snapchat.

“These are very tight-knit private groups, that’s the usual approach. When it comes to covert price-fixing arrangements, these players try to keep their actions hidden,” said Pierre-Yves Guay, deputy commissioner in charge of the Bureau’s cartels division. “I can confirm that we’re taking a very close look at some rental markets in Canada. This alert is intended to let people know this is a serious legal risk. Sooner or later, we will uncover it.”

Mr. Guay noted that while the Bureau has not historically laid criminal charges for a rent-fixing case, it has pursued real estate-related enforcement in other areas, such as access to digital listing services through the Toronto Regional Real Estate Board, and price-fixing among condo renovation companies.

Some property professionals expressed surprise at the warning, saying they’ve never witnessed any efforts to conspire on rent pricing.

“We don’t engage in any forums or discussions about industry pricing, and honestly, there’s no reason to,” said Nathan Levinson, CEO and founder of Royal York Property Management, which oversees more than 25,000 rental units across Toronto and beyond. He added that his firm offers data insights to clients, who ultimately set their own asking rents. “We deliver powerful proprietary tech and analytics tools: they aggregate data from MLS listings, internal rental history, and thousands of private listings that aren’t publicly listed. These tools empower landlords to price effectively based on current market dynamics—so they don’t overprice and lose time or underprice and miss revenue.”

In the U.S., tools using artificial intelligence to assess competitors’ rental data and generate pricing suggestions have become the focus of anti-trust cases. Canadian authorities are closely watching the U.S. Department of Justice’s lawsuit involving RealPage Inc. and various landlords. Some industry experts argue that the risk of price-fixing is higher outside major cities, where fewer landlords control larger portions of local supply.

“In the Canadian landscape, I believe this warning is more relevant to landlords and property managers of high-rise properties in smaller urban centres where they control a bigger piece of the rental inventory,” said Brandon Sage, a real estate adviser with LandLord Property & Rental Management Inc. “In Toronto, most of the rental supply—hundreds of thousands of condos and multiplex units—is spread across a large number of individual landlords.”

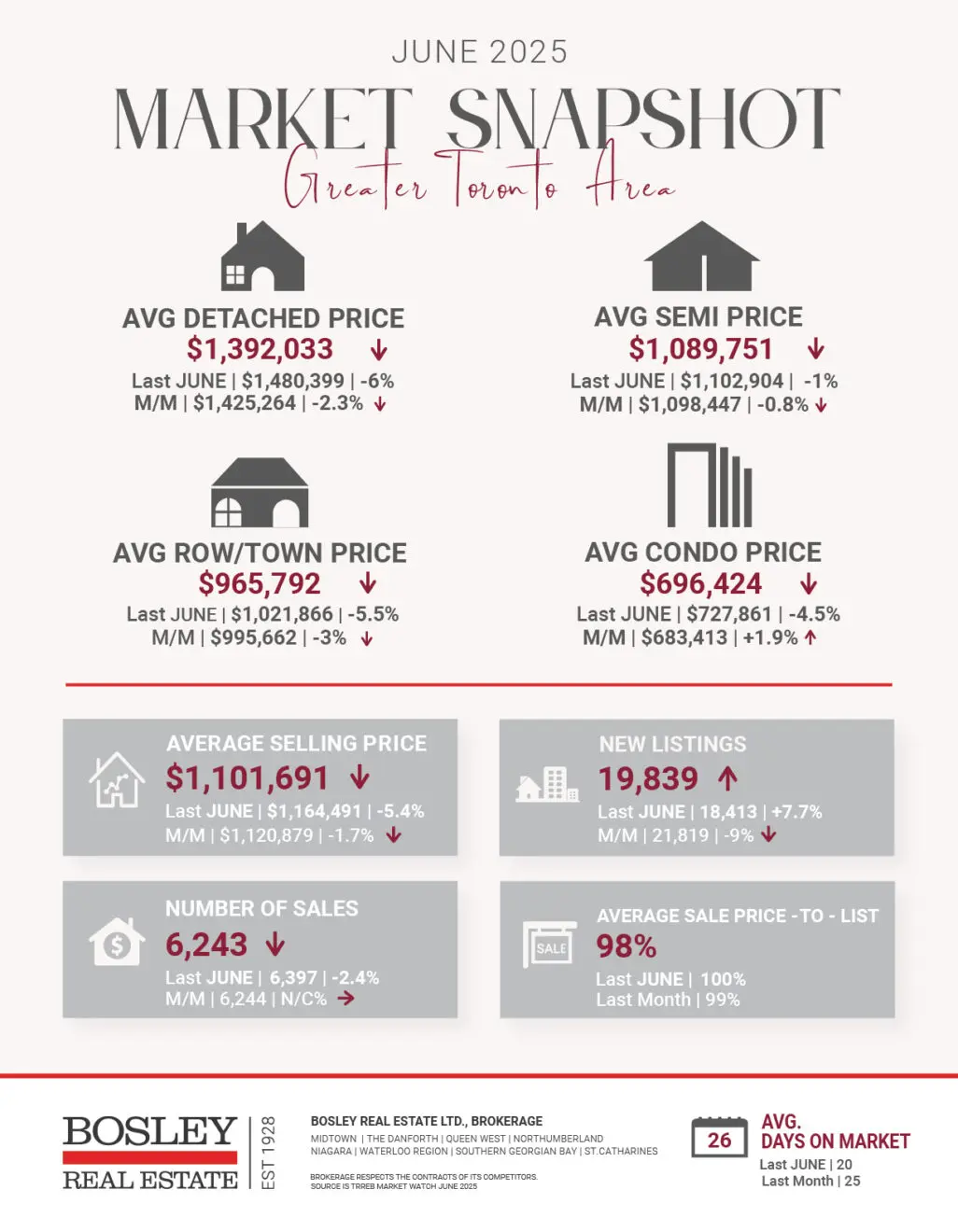

Rentals.ca reported that in Toronto, one-bedroom rents dropped 0.7% from April to May and were down 7% year over year. Two-bedroom units edged up 0.3% month-over-month but had declined by 10.7% compared with May 2024. In contrast, Ajax saw solid growth, with one-bedroom units climbing to 3.4% month- over-month and 7.8% year-over-year.

“From a Toronto perspective, it’s tough to imagine that enough landlords with enough inventory could work together to move the market,” said Ben Myers, president of Bullpen Research and Consulting Inc. “Rental developers are already competing with a massive ‘shadow’ supply of units from countless individual investors—it’s hard to believe they could effectively coordinate.”

Another challenge for any attempt at rent collusion is the other key player: the renter.

“Tenants today are highly informed; there are so many tools and platforms available to them. From what I see, if your rent isn’t competitive, tenants are quick to look elsewhere—even next door,” said Sabine Ghali, managing director at Buttonwood Property Management.

HERE ARE THE TOP FIVE TRENDING STORIES OF THE WEEK:

Canadian Rents See Ninth-Straight Month Of Decline In June

According to a recent report, the average asking rent in Canada has decreased for the ninth consecutive month. This article from Storeys breaks down the latest findings, noting a 0.7% month-over-month decline in June. While rents are down nationally from their peak in late 2024, they still remain significantly higher than pre-pandemic levels.

Vendor take-back mortgages surge as traditional lending tightens

This article from Real Estate Magazine examines the growing popularity of vendor take-back (VTB) mortgages in Canada’s current housing market. With stricter lending criteria from traditional banks, more sellers are offering VTB mortgages as a creative financing solution to close deals, making it a noteworthy trend for both buyers and sellers.

Canada, not the U.S., is seeing a ‘real’ real estate decline: report

The National Post reports on a study indicating that Canada is experiencing a more significant and “real” decline in its real estate market compared to the United States. The report suggests that when adjusted for inflation, Canadian home prices have seen a steeper drop, highlighting the differing economic pressures affecting the housing markets of the two countries.

GTA home buyers are now offering way less than the asking price

Reflecting a shift in the Greater Toronto Area’s housing market, this blogTO article notes that buyers are increasingly making offers below the asking price. This change signals a move away from the intense bidding wars that characterized the market previously, suggesting that buyers are regaining some negotiating power in a cooling real estate climate.

Mark Carney says federal housing plan needs “unprecedented” private sector buy-in

Daily Hive covers remarks from former Bank of Canada Governor Mark Carney regarding the federal government’s housing strategy. Carney emphasizes that the success of the plan hinges on securing an “unprecedented” level of investment and participation from the private sector to effectively address Canada’s housing supply crisis.

The Bosley Advantage

Read about the heritage and innovation that form the foundation for Bosley’s industry-leading approach to real estate.