The Greater Toronto Area (GTA) saw its strongest July home sales performance since 2021. Sales also rose in proportion to listings, pointing to a slight tightening of market conditions compared to a year ago.

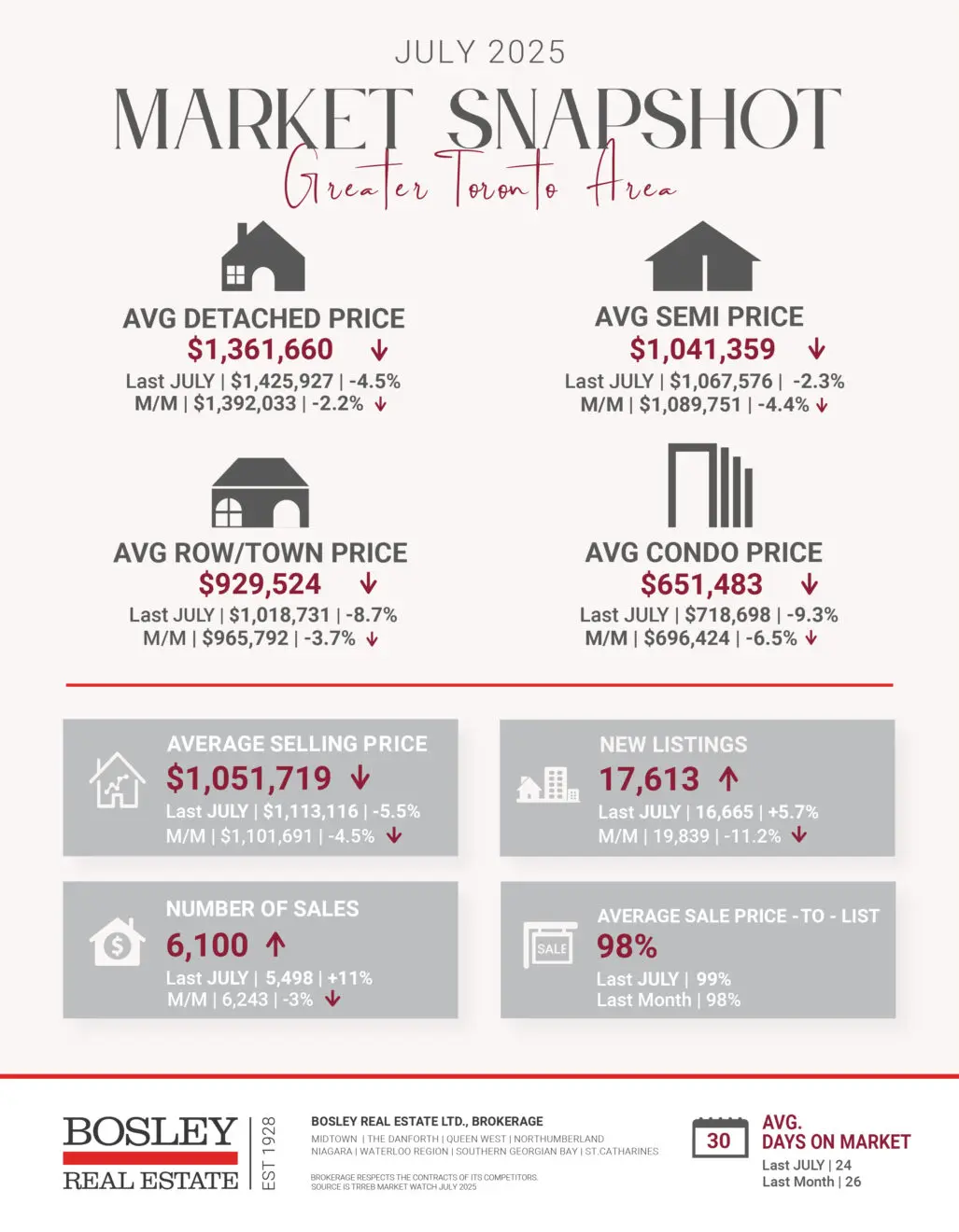

GTA REALTORS® logged 6,100 home sales through TRREB’s MLS® System in July 2025 – an increase of 10.9% over July 2024. This continues the upward momentum that began in April and represents the biggest month-over-month gain in 2025 so far. New listings on the MLS® System reached 17,613 – a year- over-year rise of 5.7%.

“Better affordability, driven by lower prices and reduced borrowing costs, is beginning to show up in stronger home sales. More relief is still needed, especially on the borrowing side, but it’s evident that a growing share of households are finding attainable paths to homeownership,” said Toronto Regional Real Estate Board (TRREB) President Elechia Barry-Sproule.

The average selling price in the GTA fell 5.5%, from $1,113,116 in July 2024 to $1,051,719 last month.

The Bank of Canada recently kept its policy rate at 2.75% for the third straight decision, offering limited respite for homeowners facing mortgage renewals. Last week’s decision held the rate unchanged again, but the central bank hinted that cuts could be on the horizon if U.S. tariffs persist. The rate remains at 2.75%.

TRREB Chief Market Analyst Jason Mercer noted that lower rates “would drive more home sales and spur spinoff spending,” boosting both economic growth and jobs. Governor Tiff Macklem remarked that the economy has shown “a degree of resilience” despite trade headwinds, though underlying inflation remains sticky.

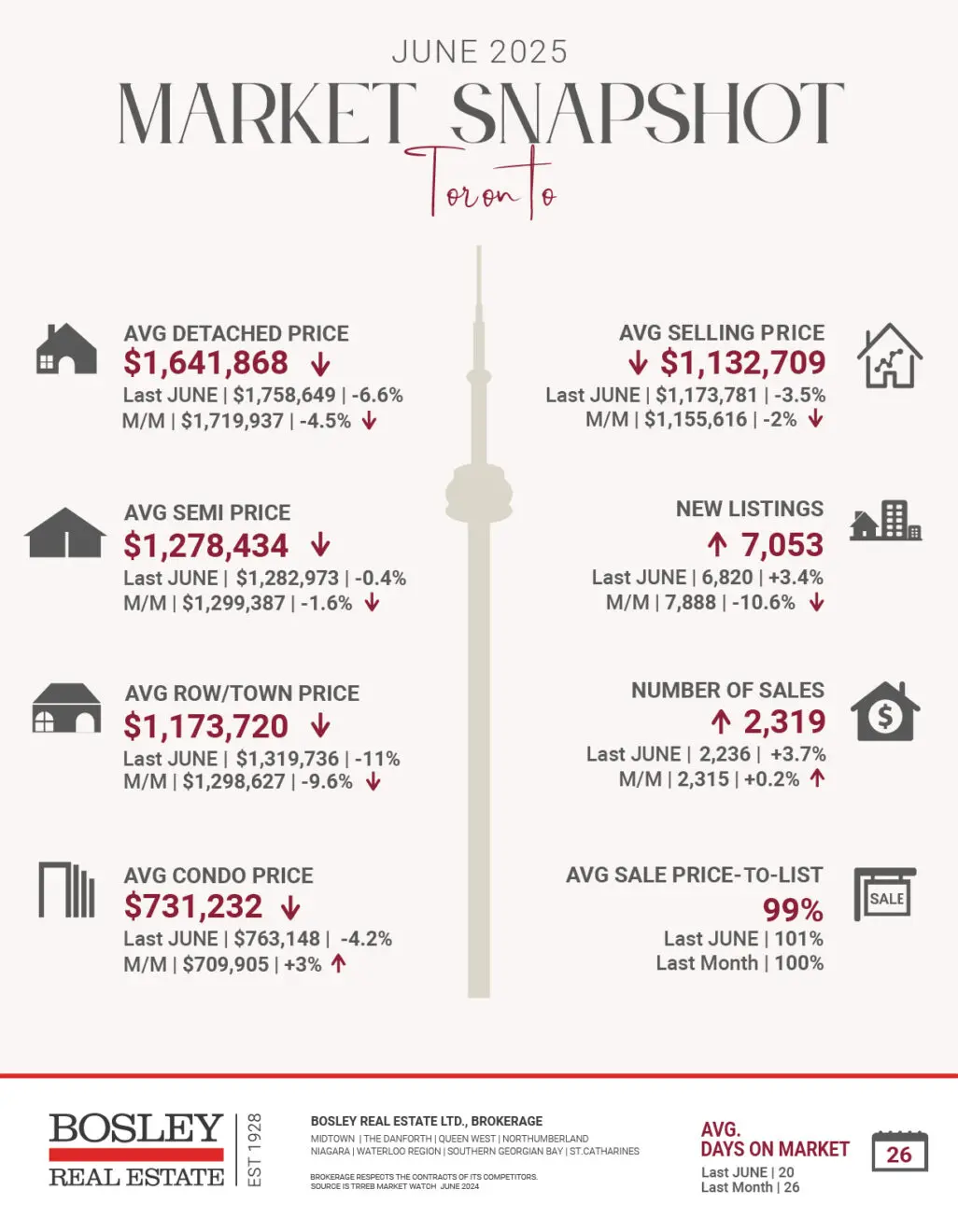

In the City of Toronto, there were 2,205 sales in July – up 11% from last year. The city’s average selling price dipped 4% year-over-year, from $1,087,436 to $1,044,576. Every property type in the region recorded higher sales than in July 2024. The sharpest sales growth was seen in the semi-detached category, up 25.5%, followed by detached homes at 11.3%. Townhouse transactions climbed 7.9%, while condo sales increased by 5.8%.

Toronto-area condo prices dropped to their lowest point in over four years in July, with a 9.3% decline bringing the average to $651,000, compared to $718,698 last year. In February 2020, just before pandemic restrictions began, the average condo price was $666,000.

The condo market has seen a notable rise in inventory over the past year, but sales have not kept pace. This segment, often dominated by first-time buyers, is particularly sensitive to interest rate changes. While falling rates over the last year have improved affordability, many prospective first-time purchasers are holding out for larger units, rather than the one-bedroom and studio apartments that have saturated the market as some investors exit due to negative cash flow.

HERE ARE THE TOP FIVE TRENDING STORIES OF THE WEEK:

Rents climbing, condition worsening for affordable housing: CMHC

A CMHC report indicates that Canada’s affordable housing is deteriorating and becoming more expensive. Rents for most unit types have increased significantly, and a larger portion of the housing stock is in poor condition.

Signs of life are appearing in Canada’s housing market

Canada’s housing market is showing signs of recovery, with increased sales in cities like Toronto. Despite economic uncertainties, buyer confidence is returning, suggesting a gradual improvement in the market for the rest of the year.

Canada, not the U.S., is seeing a ‘real’ real estate decline: report

The National Post reports on a study indicating that Canada is experiencing a more significant and “real” decline in its real estate market compared to the United States. The report suggests that when adjusted for inflation, Canadian home prices have seen a steeper drop, highlighting the differing economic pressures affecting the housing markets of the two countries.

Toronto Launches New Housing Development Office: Q&A With Jag Sharma

Toronto has created a new Housing Development Office to streamline the approval and construction of new homes. This office aims to accelerate housing development to meet the city’s ambitious goal of 65,000 new units.

Toronto home prices could hit $1.8M, Vancouver $2.8M by 2032 without major supply boost: Report

Without a major increase in housing supply, Toronto and Vancouver could see average home prices soar to $1.8 million and $2.8 million respectively by 2032. The report and subsequent discussions emphasize the need for systemic changes like zoning reform and increasing housing stock to address the affordability crisis.

The Bosley Advantage

Read about the heritage and innovation that form the foundation for Bosley’s industry-leading approach to real estate.