Now that we’re in the final quarter of 2025, year-end predictions are underway, especially for Toronto’s labouring housing market.

Across Canada, the economy has endured a particularly difficult few months marked by tariffs, job losses, a shrinking GDP, and the ongoing recession that the country still seems to be hovering near.

These factors, paired with persistently high interest rates and steep home prices, have led to an unprecedented real estate slowdown in some of the nation’s most competitive cities, primarily Toronto and Vancouver.

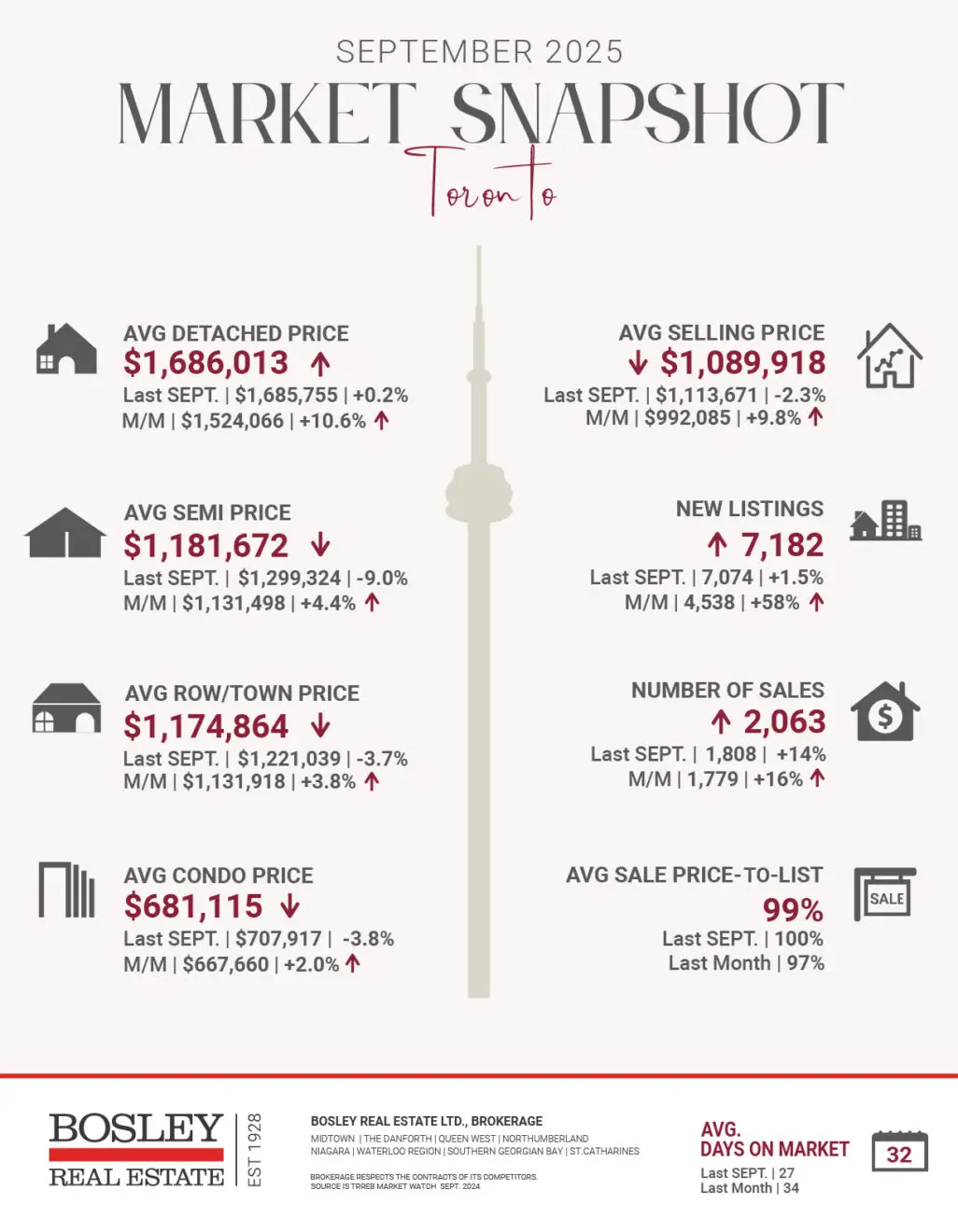

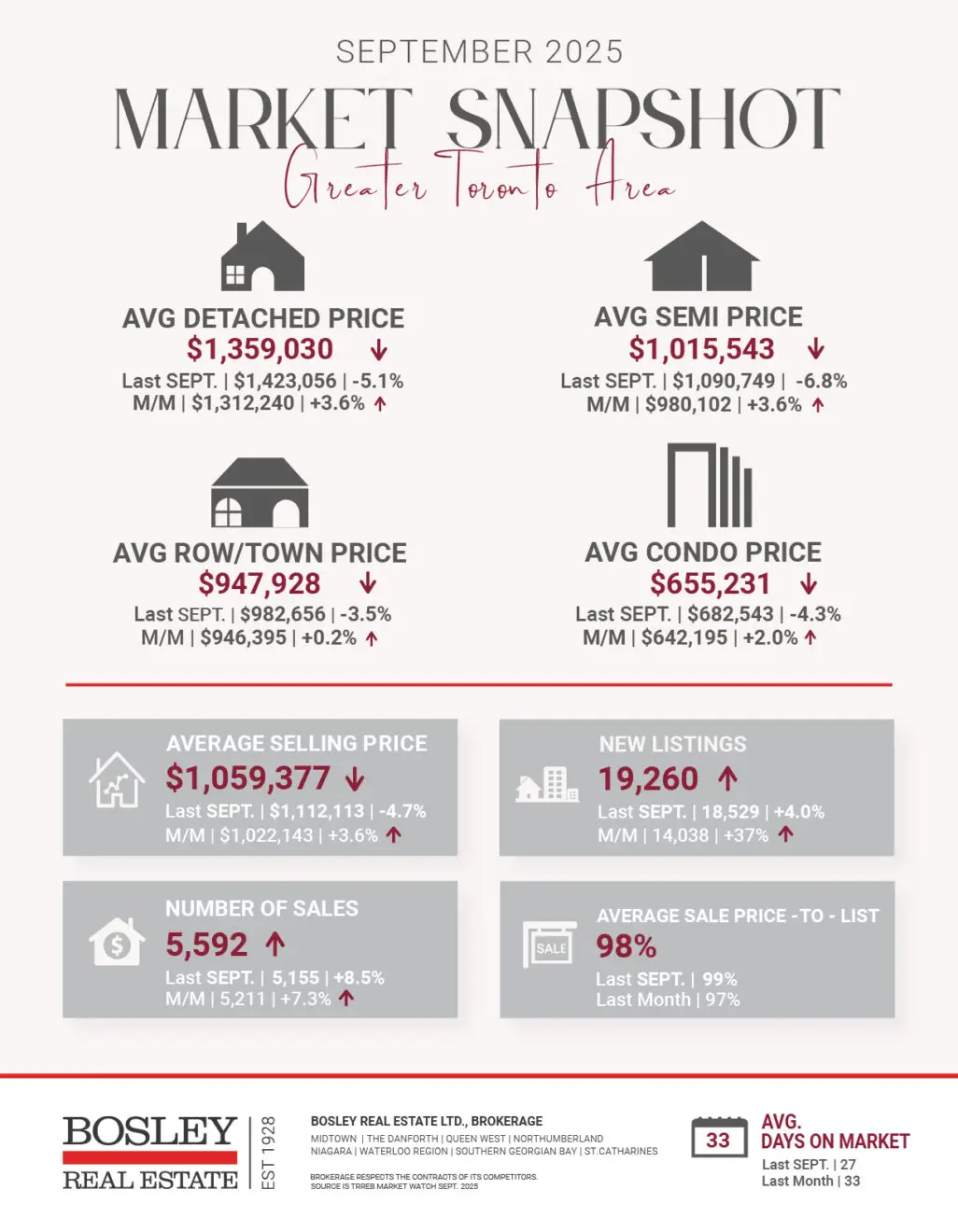

Recent updates from housing analysts suggest that prices remain under downward pressure, driven by a dwindling pool of active buyers. However, sales activity is slowly starting to recover from the historic lows reached earlier in the year.

Still, a growing number of homeowners are motivated, if not desperate to sell, widening the gap between supply and demand in a way rarely seen before.

Even though new construction is largely paused compared to previous years and planned targets, the sheer volume of listings combined with these market challenges has made buyers more selective, taking their time and negotiating prices well below what was common during Toronto’s bidding-war frenzy.

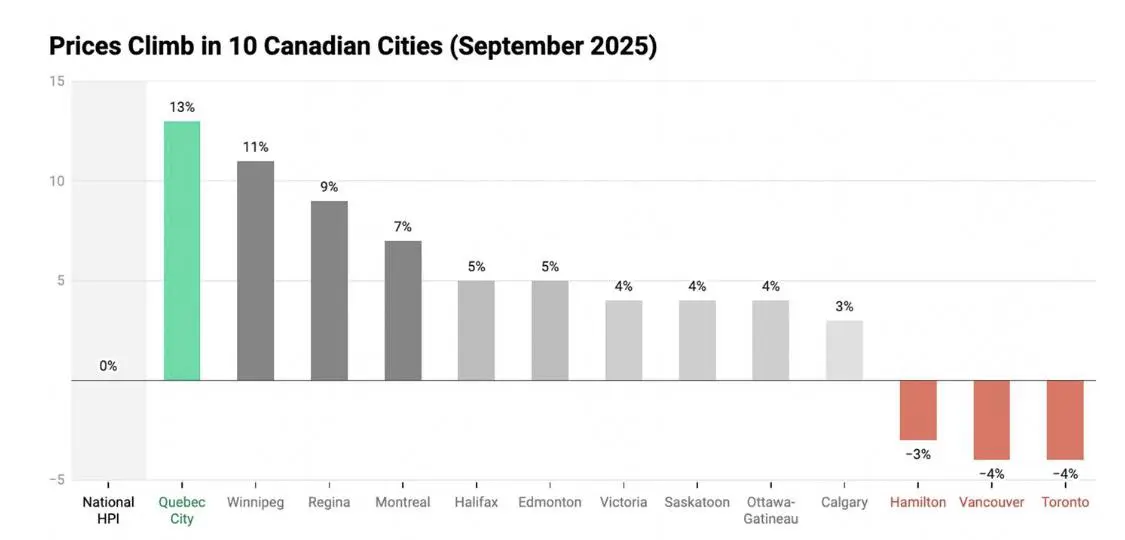

Consequently, the average price of a residential property in the GTA has dropped sharply from where it stood a year ago. Toronto and Vancouver have seen the steepest decline of any major Canadian city, one of the few markets in the country to experience a year-over-year decrease.

According to new data from Wahi, Toronto, Vancouver, and Hamilton remain the nation’s “most expensive markets, where inventory levels are at multi-year highs, homebuying demand is subdued, and housing starts are falling due to weak demand — pushing prices into negative territory.”

In contrast, once-affordable Quebec City has seen prices climb 13 per cent over the past year, while Winnipeg (+11 per cent), Regina (+9 per cent), and Montreal (+7 per cent) have also posted notable gains, driven in part by population growth and migration.

On an upbeat forecast CREA (Canadian Real Estate Association) forecasts a dip in home sales for 2025 followed by a rebound in 2026, while national average home prices are expected to see a modest decline in 2025 and a larger increase in 2026.

Specifically, sales are predicted to decrease by 1.1% in 2025 and rise by 7.7% in 2026. For prices, a 1.4% drop is forecast for 2025, and a 3.2% increase is expected in 2026.

Economists are forecasting Toronto’s average home prices to rise by 1.5 per cent in 2026, following a decline of 3.8 per cent in 2025. In Vancouver, prices are expected to drop by 3.9 per cent this year before they rebound with a 3.1 per cent increase next year.

Markets move in cycles, and even in challenging times, momentum always returns. Real estate has always been about resilience and timing—and right now, knowledge and patience are powerful tools. Better days are ahead, and they often start when things feel the toughest.

For buyers and investors, this is a time to stay alert—slow markets often bring the best long-term opportunities. Smart moves made now can pay off when the market turns.

HERE ARE THE TOP FIVE TRENDING STORIES OF THE WEEK:

Toronto real estate leader Ann Bosley remembered for industry impact

The Toronto real estate community is mourning the loss of Ann Bosley, a widely respected leader and trailblazer. Remembered for her significant contributions as the past president of both the Toronto Real Estate Board and the Canadian Real Estate Association, Bosley is being honored for her lasting impact and for paving the way for women in the industry.

CIBC’s Ben Tal: Canada is in a ‘per-capita recession’ and needs rate cuts now

Benjamin Tal, a top economist at CIBC, is sounding the alarm on Canada’s economic state, declaring it to be in a “per capita recession” — a scenario where economic output is shrinking relative to the growing population. In response to this downturn, Tal is making a strong case for the Bank of Canada to begin cutting interest rates immediately to provide needed stimulus.

‘Realtor first, creator second’: Anya Ettinger talks winning business online

In an industry increasingly focused on social media, Realtor Anya Ettinger shares her successful strategy for online engagement. This article explores her “Realtor first, creator second” philosophy, detailing how she prioritizes professional expertise over content trends to build trust and successfully attract clients through her digital presence.

These are the tax incentives Canadian homeowners need to know about in 2025

As the 2025 tax season approaches, this article outlines the key tax incentives and credits available to Canadian homeowners. It covers a range of programs, including the Home Buyers’ Plan (HBP), the First Home Savings Account (FHSA), and various tax credits for accessibility-related or “green” home renovations, helping homeowners maximize their potential savings.

A record number of condo projects in Toronto are being cancelled

Toronto’s pre-construction condo market is facing significant challenges, with a record number of projects being cancelled. Citing difficult market conditions and financial headwinds, developers are shelving plans, leaving many hopeful buyers in the lurch and highlighting the growing instability in the new-build sector, as seen with the recent cancellation of the Cloverdale Mall condo development.

The Bosley Advantage

Read about the heritage and innovation that form the foundation for Bosley’s industry-leading approach to real estate.