MARKET INSIGHT FOR THE WEEK ENDING November 10th

GTA buyers are walking away from deposits on new build homes.

Troubling headwinds continue to persist in the preconstruction real estate industry as homebuyers are unable to close their transactions and are walking away from sizable deposits, some worth as much as $300,000.

It’s a new phenomenon, industry experts say, particularly in low-rise homes in the GTA suburbs where prices ran up quickly during the pandemic and have fallen drastically. As closing dates near, buyers are unable to close as appraisals fall short or they’re unable to qualify for a mortgage.

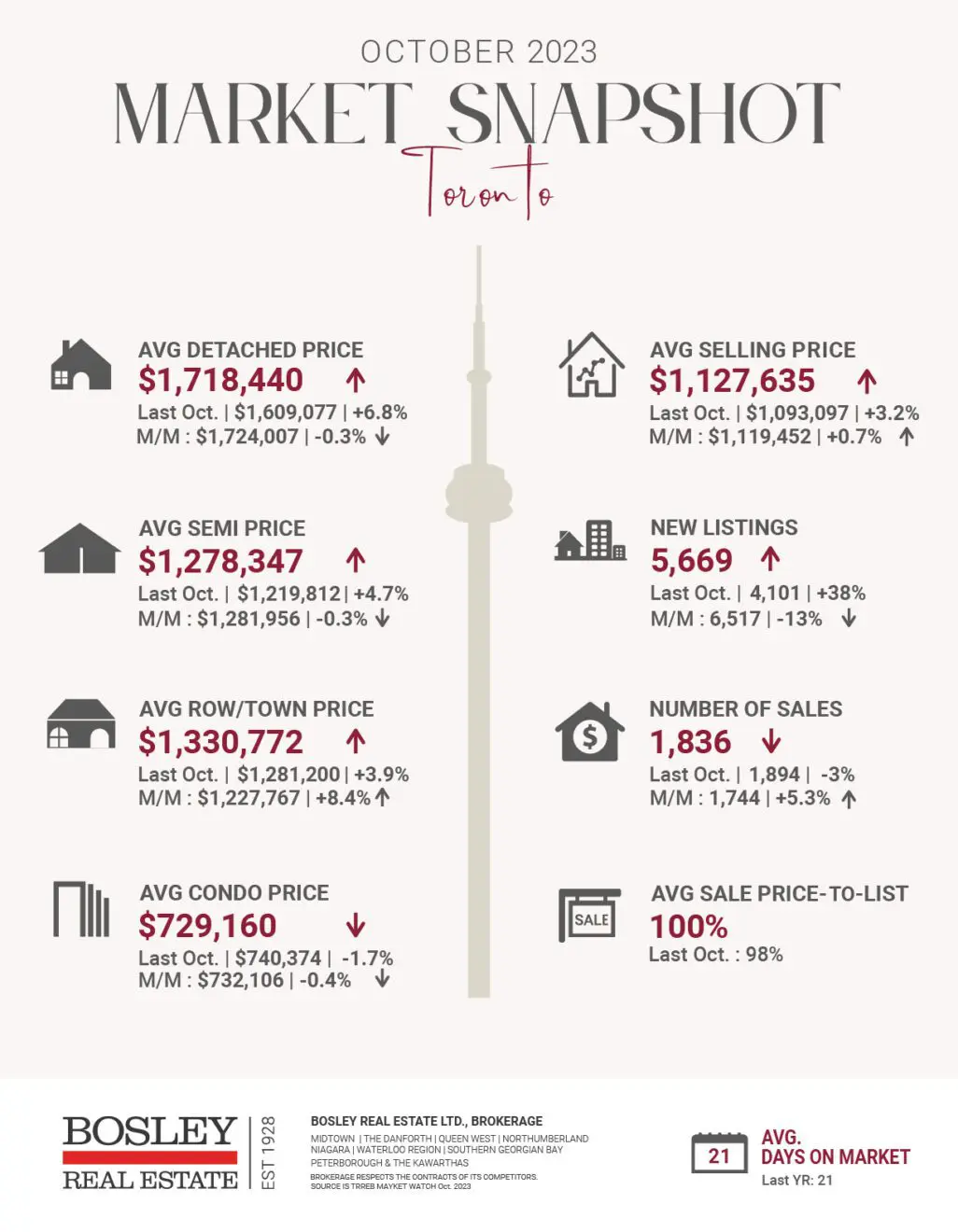

The issue is compounded by a sudden drop in sales across the GTA, according to the most recent numbers from the Toronto Regional Real Estate Board. New figures released showed unit sales falling six per cent in October compared to the year prior. Average prices have continued to deflate as well, dropping to $1,125,928 in October from $1,195,469 in May.

Some of the buyers walking away are end-users and some are trying to off-load an assignment sale — a legal transaction in which the original pre-construction condo buyer transfers the rights and obligations of the purchase agreement to another buyer.

Buyers who bought a preconstruction low-rise home at the tail-end of 2021 or the beginning of 2022 when prices were astronomically high with extremely low-interest rates are having to close in a drastically changed interest rate environment. Home prices are softening, and people are having to qualify at eight per cent interest on their mortgage.

A typical deposit is 20 per cent of the final purchase price, which is generally given to the developer before the project has broken ground, said Mark Morris, a lawyer at real estate law firm Legalclosing.ca.

If the buyer doesn’t close on the property upon completion, and pay the remainder of the purchase price, the builder can seize the deposit and sue for any damages, he said. If the builder resells the property for significantly less than what the original buyer bought it for, “they can come back and ask the original buyer for the difference in cost,” he added.

Experts have noticed buyers walk away from deposits that are hundreds of thousands of dollars. On assignment sale Facebook groups, some of the deposits are as high as $320,000.

We’re seeing it happen the most in cities that are an hour or two outside of Toronto, where people paid $1 million for a property and are now getting appraisals of $600,000,” Morris said. “They’d rather face the builders’ wrath and walk away, than close on that transaction.”

Around five to 10 per cent of people are walking away from their deposits in the low-rise space, which is very high and uncommon. And around two per cent of people are walking away from deposits in the condo sector.

This is an evolving story. It will become very common in the next few years, especially as condos come to the market from people who bought at the height of the pandemic. It poses a risk to lenders and builders.

Here are the top 5 trending stories of the week:

- Canada Hides Its Vacant Home Count With Last Minute Registration Delay… Again “Canada is serious about tackling real estate speculators… just not anytime soon. Just hours before the Oct 31st vacant home filings were due, the deadline was delayed by six months. The last minute change is the second extension, and delays the vacant home count. It’s quickly becoming a trend for policymakers to publicly pass aggressive housing policy, then undermine that policy during the execution phase.”

- 6 tax incentives Canadian homeowners should take advantage of “Owning a home in Canada isn’t cheap, but luckily, there are tax credits and benefits that can help you get some extra cash to maintain your dream home. The country is facing a cost of living crisis, which is made up of soaring food prices and unaffordable housing, to name a few. Costs are at the forefront of most Canadians’ minds right now, especially homeowners. With the past few interest rate hikes, homeowners might be wondering how they can renovate existing properties for evolving needs.”

- Colleges, Universities Descend On Toronto’s Vacant Office Space “As demand for office space continues to decline, colleges and universities are swooping in to pick up the square footage left behind. A seamless alternative to residential conversions, the trend has been playing out across the Greater Toronto Area since the start of the pandemic, with a noticeable uptick over the last year as the number of international students coming to Canada grows.”

- Urbanation: Q3-2023 Condominium Market Survey results “Greater Toronto Area (GTA) new condominium sales totaled 2,664 units in Q3-2023, up 41% from a year ago in Q3-2022 when presale activity was effectively ground to a halt as interest rates began rising rapidly but representing the second lowest Q3 total of the past 20 years. Year-to-date sales of 9,568 units were at their lowest level in 10 years and down 47% from the same period in 2022”

- Desperate Ontario builders are literally giving away gold bars to lure home buyers “Real estate developers in Ontario have taken on a new level of desperation amid a shakey market fuelled by sky-high lending rates; they will literally give you bars of gold just to buy a home. A new subdivision of single-family detached homes in Woodstock, known as River & Sky, is gearing up to launch — and the project is attempting to lure in buyers with a promotion offering 500-gram gold bars worth a staggering $45,000 a pop to anyone who buys one of these homes.”

The Bosley Advantage

Read about the heritage and innovation that form the foundation for Bosley’s industry-leading approach to real estate.