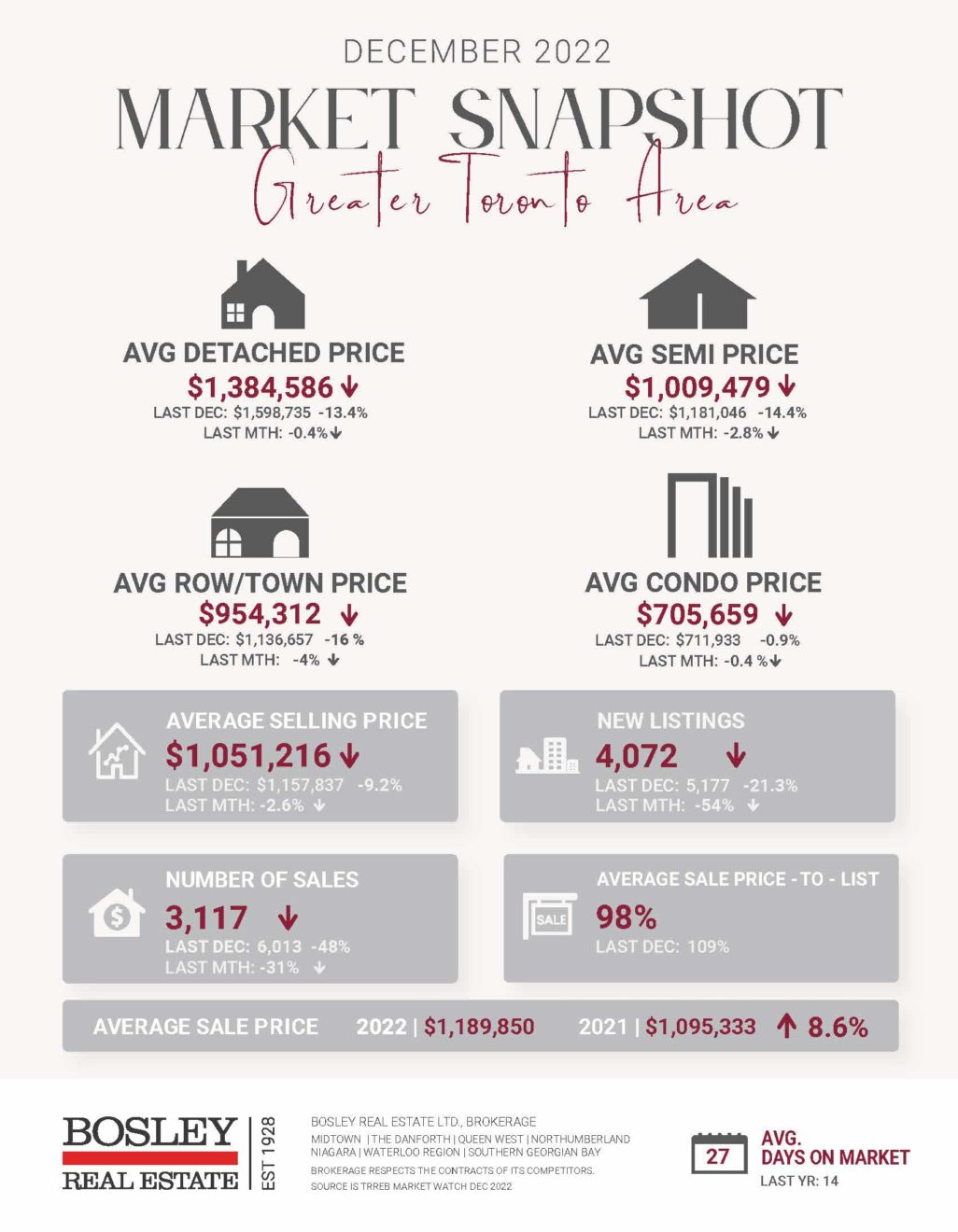

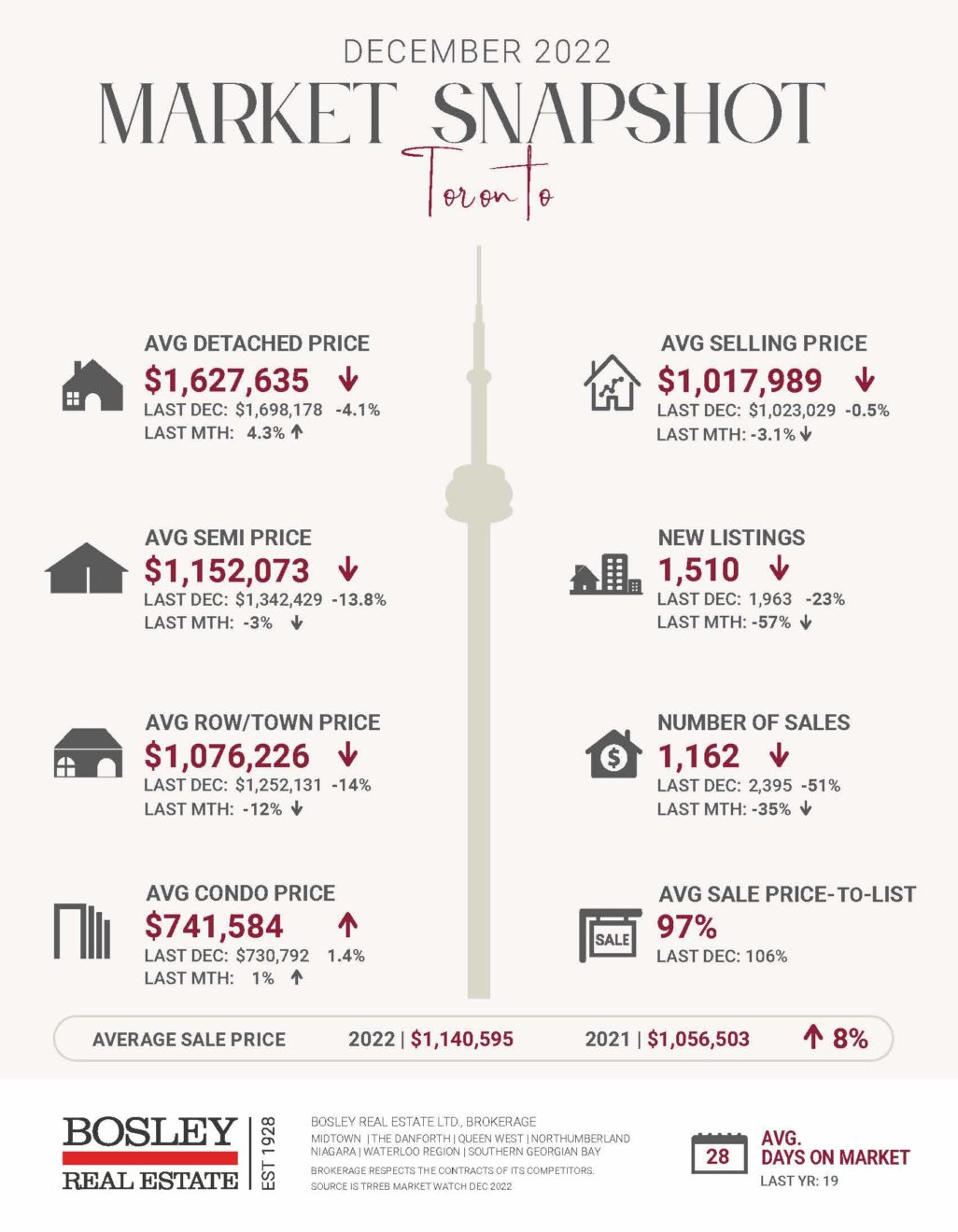

Even fast-rising mortgage rates couldn’t stop the rise of Toronto real estate prices in 2022 . The average selling price of all GTA homes was up 8.6% or $1,189,850 in 2022, up from $1,095,333 in 2021, the Toronto Regional Real Estate Board (TRREB) reported. For the City of Toronto, the average selling price was up 8% or $1,140,595 for 2022 compared to $1,056,503 in 2021.

There were 75,140 sales reported through TRREB’s MLS System in 2022. That’s down 38.2% compared to the 2021 record of 121,639. The number of new listings amounted to 152,873 – down 8.2% compared to 166,600 new listings in 2021. With the supply of new listings being down, this helps to explain why selling prices have found some support in recent months. “We’re starting to see a flat-lining in terms of prices and I think that trend is going to carry forward through the first half of 2023, give or take,” Mercer said.

The annual gain was due mainly to the strength of last January and February’s market when prices peaked at $1.33 million. In March, the Bank of Canada began raising interest rates, and that slowed activity but didn’t immediately push down prices on a yearly basis, said Jason Mercer, the real estate board’s chief market analyst. “Even as we moved through some of the summer months, we were still seeing prices up on a year-over-year basis,” he said. “But that annual rate of growth was certainly trending lower through the year at the point where now we’re obviously down on a year-over-year basis.”

Generally, the 905 communities saw the biggest drop in home prices. Detached houses in the City of Toronto fell 4% to an average selling price of $1.63 million, compared to 905 detached homes, which fell 16.4% to $1.31 million on average. As we look forward to 2023, there will be two opposite forces impacting the housing market. On the one hand, we will continue to feel the impact of higher borrowing costs. On the other hand, record levels of immigration will support demand for ownership and rental housing.

However, mortgage rates are expected to remain at relatively elevated levels and the central bank has said its interest rate hiking cycle is not over yet. Let’s see what the Bank of Canada does on January 25th.

As your local real estate brokerage, we strive to always provide valuable information as it relates to your largest investment. At the beginning of every month, we work to compile statistics relating to both Toronto proper and the larger GTHA region. Simply provide your contact information below, and we’ll be sure to send our infographics your way every month until you tell us otherwise. Enjoy!

Here Are The Top 5 Trending News Articles Of The Week:

1. Canada’s new ban on foreign homebuyers is now in effect

“The regulations for the ban on foreign homebuyers in Canada come into force on January 1, 2023. The ban means that foreign commercial enterprises and people will be prohibited from purchasing residential properties in Canada for two years. “ Read More

2. What to Expect From Canadian Real Estate in 2023

“Despite a strong start to the year, real estate in 2022 was largely defined by a lack of affordability, spurred by one of the most polarizing interest rate hike cycles in Bank of Canada (BoC) history.” Read More

3. Will the Bank of Canada raise mortgage rates again in 2023? Here’s what industry experts predict

“While many homeowners with variable rate mortgages and lines of credit have seen their monthly mortgage payments increase by hundreds of dollars a month, some industry analysts believe the time for rate hikes has come to an end. ” Read More

4. Why Aren’t Millennials Having Children? It Might Be Due To High Real Estate Prices

“Millennials aren’t having children and experts believe high home prices are a big part of the issue. An NBER working paper titled House Prices and Birth Rates: The Impact of the Real Estate Market on the Decision to Have a Baby looks at the influence of home prices on births.” Read More

5. Canada Has Seen Suspicious Money Reports Surge and It’s Investigating A Lot Less

“Canada has earned itself a reputation as a hub for dirty money over the past years, and it doesn’t seem to be phased by it. Financial Transactions and Reports Analysis Center of Canada (FINTRAC) data show reports of suspicious transactions have surged higher in recent years.” Read More

The Bosley Advantage

Read about the heritage and innovation that form the foundation for Bosley’s industry-leading approach to real estate.